Trusted by Leading Products

Features That Set Us Apart From Others

Ensure maximum protection of sensitive information with robust encryption features and prevent fraudulent transactions automatically.

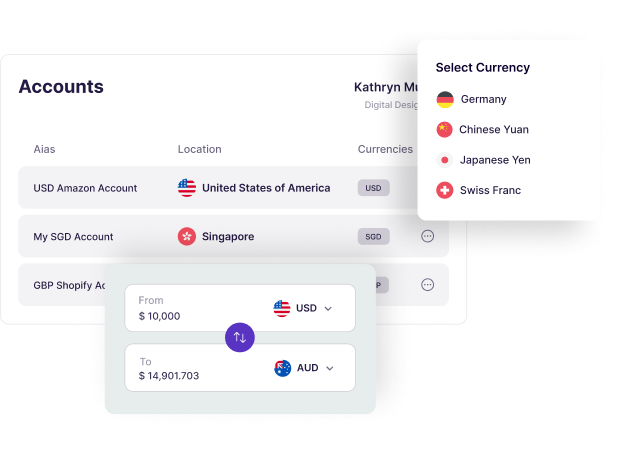

With Walcy’s Global Account you can manage, hold, and exchange multiple currencies in a single place. It is a primary account that is accessible and manageable from any location. Moreover, you can open a global account online from anywhere in the world with a hassle-free KYB Process.

Walcy’s Global Account intends to simplify financial processes and flexibly provide companies with a convenient cross-border transaction experience.

‘Walcy’ facilitates fast, secure, and cost-effective international payments. It simplifies cross-border transactions by supporting global payments in a variety of currencies for both people and businesses. This solution is particularly helpful for businesses that operate internationally or deal with clients, suppliers, and employees from other countries.

With Walcy you can collect global payments in up to 25 currencies instantly from anywhere in the world. Pay anywhere at any time across the globe using Walcy!

FX, commonly known as “Forex” or “Foreign Exchange” is another solution of Walcy. Walcy provides competitive foreign exchange rates and low fees for spot and forward transactions. This platform enables clients to execute currency conversions and manage currency risk efficiently.

You can also enjoy real-time currency conversions instantly on the platform, with up-to-date exchange rates.

‘Walcy’ offers virtual cards & expense management solutions that can be used globally and support multiple currencies. These solutions help businesses streamline their expense management processes and monitor spending more effectively. You can easily modify the spend limits of corporate cards, and temporarily freeze or revoke card access. Moreover, there are no foreign currency exchange fees and foreign transaction fees.

An API (Application Programming Interface) integration is a mechanism that allows the exchange of information between two or more applications through their specific APIs.

Walcy provides API integration for businesses looking to automate payment processes, foreign exchange transactions, and account management. This allows companies to integrate Walcy’s services into their existing systems, creating a more seamless and efficient financial management process.

Getting started with Walcy

Tap into the world of global payments network

Walcy’s Global payments service offers a faster, cost-effective, and transparent alternative for cross-border transactions. Operate like a local business globally, open accounts quickly with company incorporation documents, accept payments in local currency, avoid conversion fees, hold funds in foreign currency accounts, and make high-speed transfers worldwide with ease.

$5 Mil

Threshold per transfer

138+

Countries to transfer funds

25+

Countries to open account

180+

Countries to accept payments from

Testimonials from Our Valued Customers

“ Walcy has transformed our international transactions! Their seamless global payments and excellent support have made cross-border operations effortless for EasyFiling. Highly recommend!.”

“Walcy is a game-changer for Tivazo. Their user-friendly platform and multi-currency accounts have simplified our global payments, saving us time and money. Fantastic service! .”

“Walcy’s global bank accounts have streamlined our international payments. Secure, efficient, and cost-effective – KrispCall couldn’t be happier with this partnership!.”

Frequently asked questions

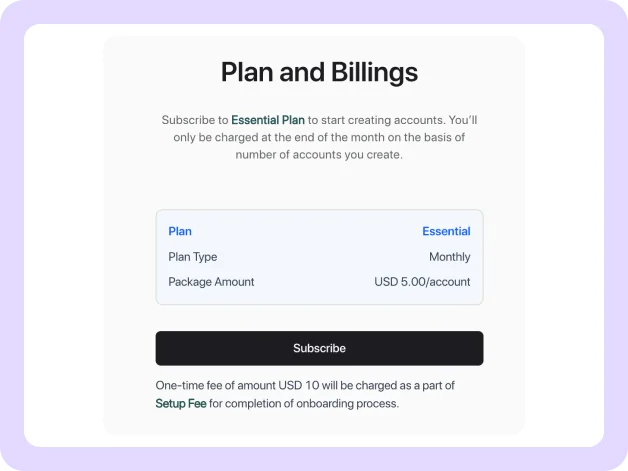

Walcy is not exactly like a conventional bank but rather a neobank, which facilitates financial services by aggregating offerings such as opening bank accounts, managing payments, facilitating FX, and providing virtual cards. Like most fintech companies, Walcy offers these services through intuitive web and mobile applications.

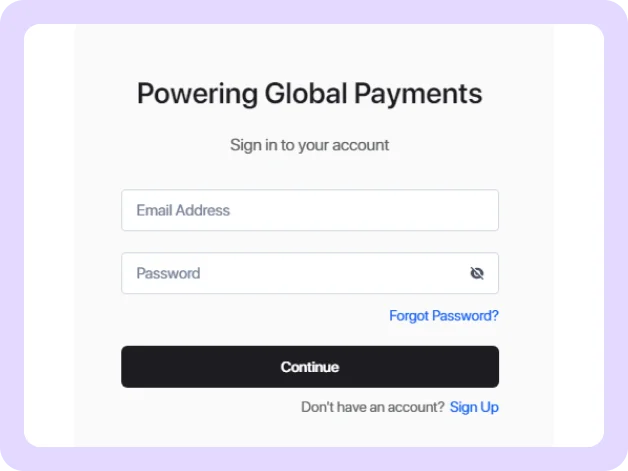

Within minutes, once you register on Walcy’s payment platform using a valid email and phone number and submit all the required documents, you can open a named global bank account.

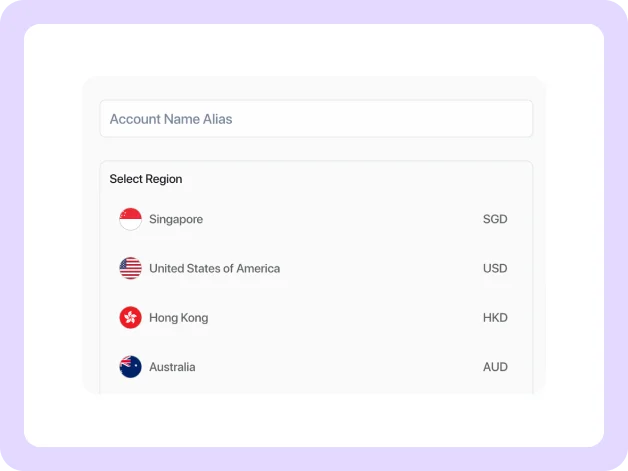

Walcy’s Currency Accounts are real named bank accounts that allow users to hold foreign currency denominations in another country and transfer them globally.

Click on the “Get Started” button at the top, which redirects you to our registration page. Enter your valid email and phone number credentials, and submit your business incorporation documents to our team. Once verified, you can easily create a named bank account in your desired currency denomination.

Security is paramount for Walcy. We regularly assess our system security, perform VAPT (Vulnerability Analysis and Penetration Testing), monitor and observe our systems, and ensure our providers and banking partners are PCI DSS compliant. In conclusion, Walcy is very secure.

The number of supported countries is growing regularly. Currently, we support the creation of named bank accounts in more than 25 countries: the USA, Singapore, Australia, Canada, the UK, Hong Kong, Japan, New Zealand, Indonesia, Philippines, Hungary, China, Israel, Saudi Arabia, South Africa and Europe (SEPA).