Integration

Connect Your Finances

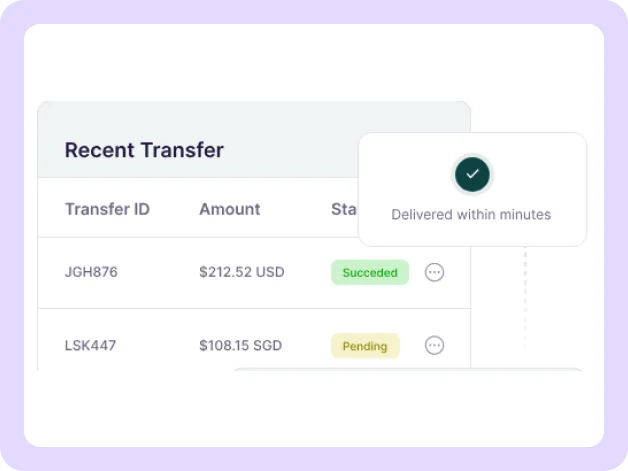

Connect and manage your finances more easily and effectively through our API.

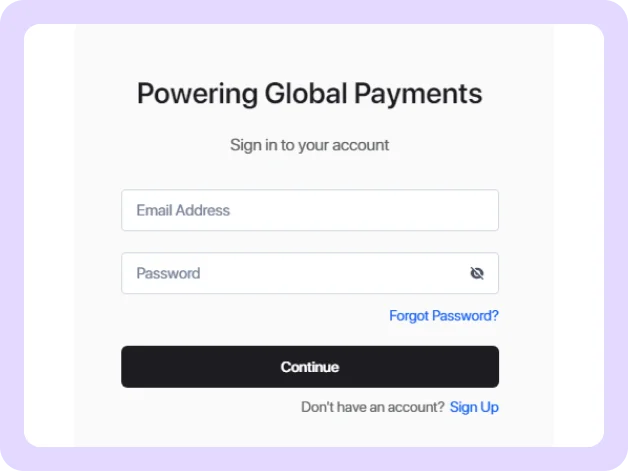

How Does It Work?

We provide a step-by-step guidance on API, documents and it’s management.

Frequently Asked Questions

Walcy is not a bank but it’s similar to other fintech companies who offer digital center to manage their accounts, payments, virtual cards & all.

We do VAPT (Vulnerability Assessment and Penetration Testing) on our Network and Applications regularly. Besides, we do not store any of your sensitive data, card details, and our partners are all fully PCI DSS compliant.

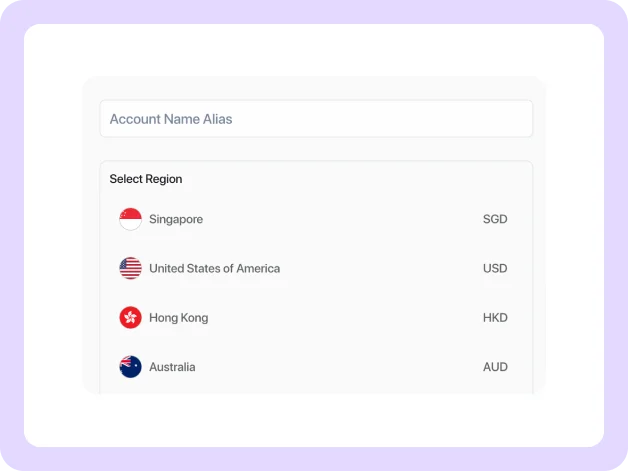

Walcy account is an all-in-one business account for modern digital business owners. It allows you to transfer, receive and spend money through the Walcy web, mobile app and the Walcy visa card. On top of that, your Walcy account will cover your business financial needs by providing you access to multi-currency accounts and it’s management solutions. There’s no need to manage a bunch of disconnected financial service providers. Scale faster with everything in one place with Walcy!

We have not any additional fees or hidden charges. But there will be some charges for ATM withdrawals in foreign countries, charged by the banks and payment networks. Also, there will be fees charged for FX transactions, but it will still be lesser than bank charges.

Virtual card are unique cards that provide extra security and control over the online transactions. Users can create and dedicate unique card for each online vendor, providing flexibility to manage them aptly and also isolating your main account from any fraudulent activity associated with a particular vendor.