Global Accounts

Empowering your business to grow

Simplify your international finances. Securely manage your funds across borders with our Global Accounts

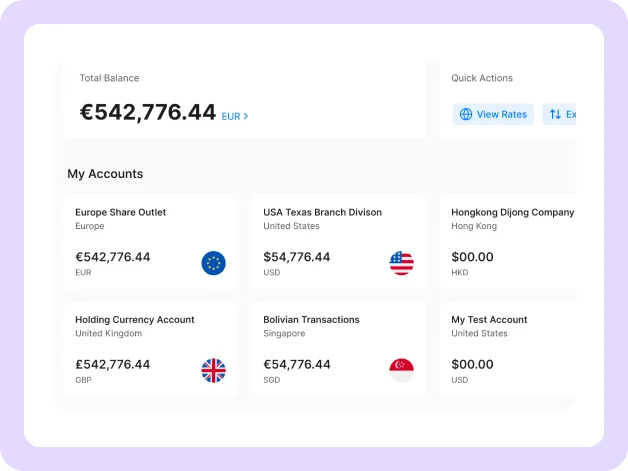

Send, Receive and Hold funds globally

Walcy’s global account enables you to easily oversee several currencies, which leads to superior overseas currency movement

We have got you covered

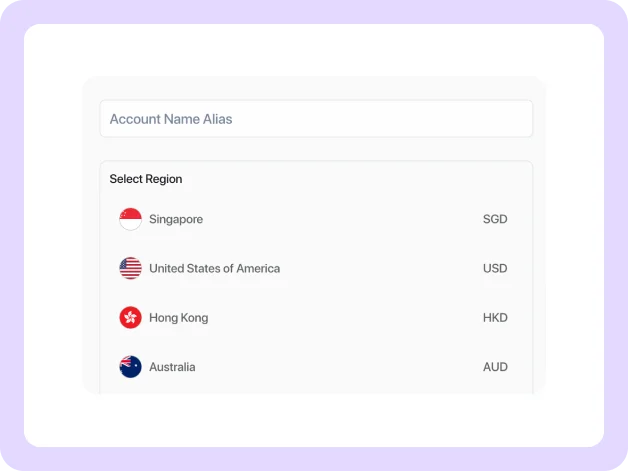

Walcy’s global account lets you open bank accounts in 8 different countries and currencies

Get your account Number, right away!

Get your Routing (ABA) Number and Account Number.

Get your institution, Transit, and Account Number.

Get your own Account Number and Sort Code.

Get your own SWIFT/BIC details and IBAN details.

Get your Routing (ABA) Number and Account Number.

Get your institution, Transit, and Account Number.

Get your own Account Number and Sort Code.

Get your own SWIFT/BIC details and IBAN details.

What Set Us Apart

Walcybank’s global account simplifies the transaction across borders.

Easily Open and Manage Multiple Currencies

Walcy allows you to open a multi-currency account with just a few clicks. You can easily open and manage your account in the US, Canada, UK, Europe, Hong Kong, Japan, Australia, New Zealand, and several other nations.

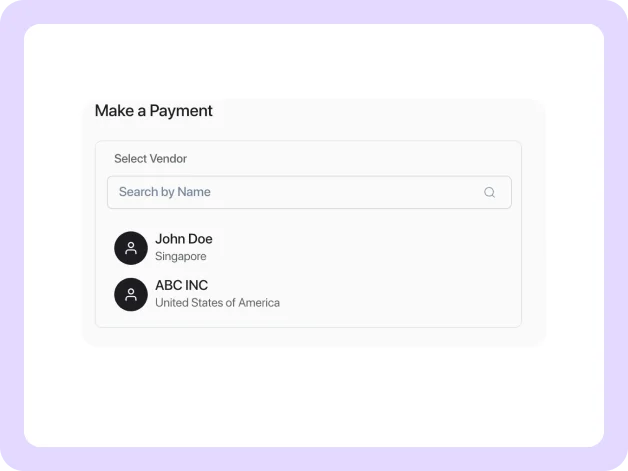

Customer Centric Payments

You can accept payments in your customers’ preferred currency & make it easier to reach your footprint globally.

No Local Bank Account Needed

After having a Walcy’s you need not have a local bank account. You can easily make and receive payments in the global account.

Saving on Foreign Transactions

With unbeatable foreign exchange rates and low transaction costs, you can save a lot while making foreign transactions.

Easily open and manage multiple currencies

Walcybank allows you to open a multi-currency account with just a few clicks. You can easily open and manage your account in the US, Canada, UK, Europe, Hong Kong, Japan, Australia, New Zealand, and several other nations.

No Local Bank Account Needed

After having a Walcy’s you need not have a local bank account. You can easily make and receive payments in the global account.

Customer Centric payments

You can accept payments in your customers’ preferred currency & make it easier to reach your footprint globally.

Saving on foreign transactions

With unbeatable foreign exchange rates and low transaction costs, you can save a lot while making foreign transactions.

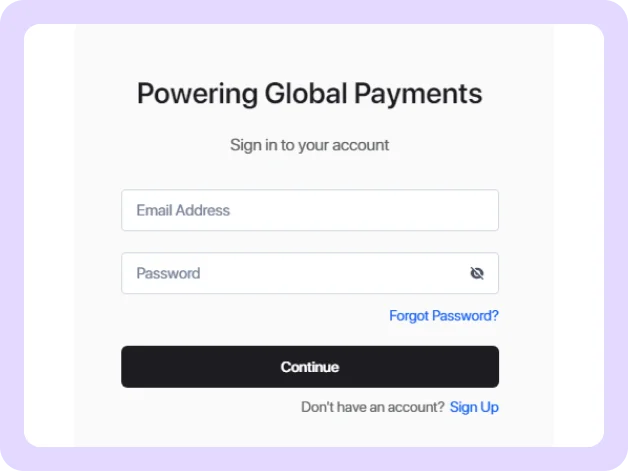

How does it work?

Using Walcy’s Global Account is easy, secure, and convenient. It is an all-in-one business account to empower your global business.

Frequently Asked Questions

Yes, we provide you with real bank accounts from our partner banks, and all transactions and funds are handled via our partner banks. Walcy simply provides a platform to access the global banking system.

Usually, it takes 1 to 2 business days to open a Global Bank Account once all the necessary Know Your Business (KYB) documents are submitted to our compliance team.

Register with your genuine company email and phone number, and submit the requested documents for Know Your Business (KYB) verification. After the KYB verification, pay a one-time onboarding fee and select the desired currency account.

There is no minimum balance requirement with Walcy’s Global Bank Account.

Our platform is highly flexible and can handle large and bulk transactions. However, we have a soft limit of 5 million dollars per transaction.