Card security is one thing that can never be taken for granted in today’s digital world. The Card Verification Value, more popularly known as CVV, while making online transactions, is a major security feature. It’s a three- or four-digit code located on your debit or credit card, used for shielding your financial information against fraud while you make online payments.

Let’s walk through the internals of the importance of a CVV code, their location, and how they work.

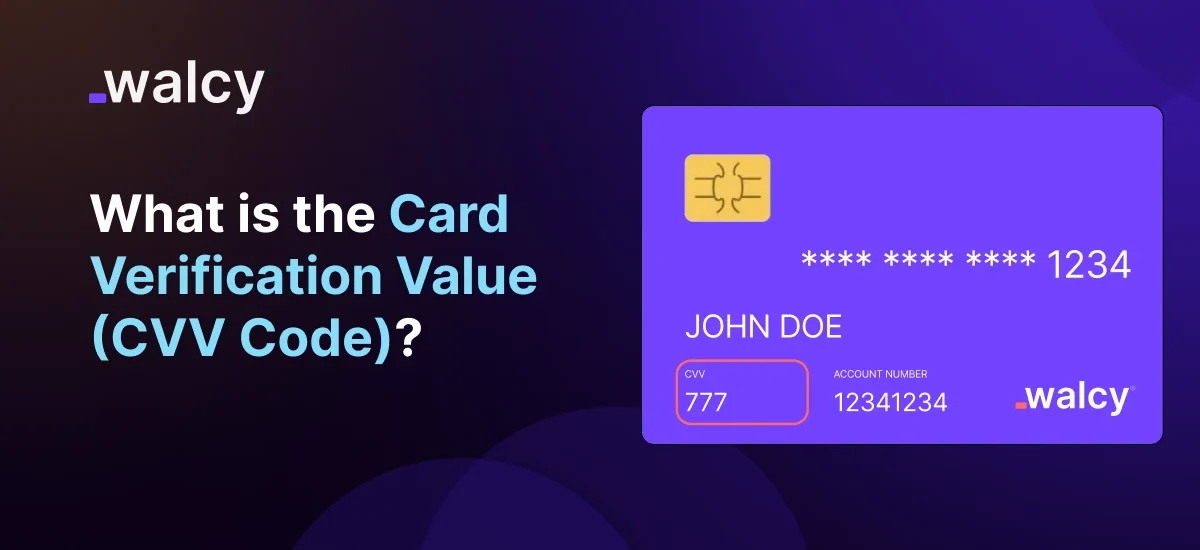

What is Card Verification Value (CVV)?

While all credit and debit cards have a CVV feature for added security for card transactions, most payments are normally made using your card number and expiry date. The code, however, can only confirm that the person using the card is in actual physical possession of the card.

There are two types of commonly used CVV codes:

CVV1: The electronic storage is done on the card’s magnetic stripe. Because they are for in-person or swipe transactions, it authenticates that a card is indeed genuine by having the card physically swiped at a terminal. It adds counterfeit card protection.

CVV2: This is a three- or four-digit code printed either on the back or the front of your card and is mainly used for online or phone transactions. It confirms that the very person doing the payment has the card in his physical possession to further minimize fraud associated with card-not-present transactions.

In most cases, the term CVV usually refers to the value on the card verification of CVV2.

Where to Find the CVV on Debit and Credit Cards?

About the location of the CVV, debit and credit cards differ by card network. For most major issuers, including Visa, Mastercard, and Discover, the CVV is three digits on the back of the card, generally positioned near the signature strip for accessibility in every online or over-the-phone purchase.

This three-digit code ensures an added layer of security; it confirms that the cardholder has the physical card with him during all purchases remotely.

Contrasts can be drawn with American Express cards, which have a four-digit credit card verification value. The placement of the CVV on the front of the card, above and to the right of the card number, makes the American Express card very different from other major cards.

The extra digit on the American Express card CVV serves the same function of increasing security in non-face-to-face transactions through authentication of the cardholder and lessening any possibility of fraud.

Read about: International Money Transfer Charges | How Much Does It Cost?

How Does the CVV Work?

Where an online purchase is made, it includes a card number and an expiration date, and also merchants ask for the CVV on a bank card. In simple words, the three or four-digit code of CVV will prove that the purchase has been done by one who is having the actual card-not the person who just knows the number.

In this regard, its requirement reduces the possibility of fraud cases since the CVV will serve as some kind of verification during the card-not-present transaction.

Even if a hacker has gotten your card number and expiration date, without the verification value of the cardholder authentication, they can’t complete a purchase. This further secures consumers’ purchases, as the merchant will not store this CVV but rather use it at the time of the transaction.

Not storing the CVV in the merchant database is another way to further secure your financial information from breaches and fraud.

Why is the Card Verification Value Important?

One of the major roles played by a Card Verification Value is fraud reduction, especially in e-commerce when a physical card is not presented. Retailers confirm with the customer the CVV for every online transaction to ensure that the person initiating the purchase has the card, hence making it more difficult for hackers to manipulate the stolen numbers.

Therefore, this is an extra layer of security that can further help consumers and online merchants institute trust.

Additionally, retailers are not permitted to store verification card values on their servers, which reduces the risk of stolen codes during security breaches. Since the CVV is never stored, this would mean that in the event of hacking into a retailer’s database, the CVV would remain secure and thus be an extra layer of security for customers.

While this number is by no means a catch-all solution for fraud of all kinds, it is a very important integral part of the overall risk-reduction process that is intended to safeguard customers and merchants alike against possible losses.

You shall like: Online Payment Security: Best Practices to Keep Your Transactions Safe

Protecting Your CVV Code

While the CVV in bank card transactions is taken as added security, handling this sensitive information requires much care to avoid fraudulent pursuits. Here are a few essential tips that will help you protect your CVV code:

- Never give anyone your card verification value except in a case where you are buying something from a merchant you have come to trust. Giving your CVV by phone or through email results in unauthorized transactions when it falls into the wrong hands.

- Try not to store your CVV on websites, even if they say they will save your card details in case you shop with them again. Even though that sounds practical, it might expose the CVV in case of data breaches. Consider using secure modes of paying or even digital wallets available with added security features.

- Be aware of phishing scams that might ask for your cardholder authentication verification value. Scammers will fake a website or email you, apparently from a legitimate company, and then request that you input your CVV along with other personal information. Always check to know who is requesting information from you and make sure the website you are using has indications of security, like “https://” at the beginning of the URL address.

- Keep regularly checking your bank statement and transaction history for any suspicious activity. If any unauthorized charger is found, immediately report the same to your bank. Being vigilant will minimize risks as regards your CVV and, generally, keep your card safe.

Conclusion

The Card Verification Value has been a simple but very efficient means through which your debit and credit cards are kept safe while performing online transactions. Call it either CVV or CVC; this three- or four-digit number makes a world of difference in protecting your financial information from falling into the wrong hands through verification that the actual person making a purchase has the physical card.

Knowing the card verification value and how it works will give you the edge in being proactive toward safeguarding your online purchases and reducing the probability of fraud.

In today’s world, as the majority of transactions are digital, safeguarding card verification value on debit and credit cards can save you from fraud and mismanagement of personal finances. Be very discreet with sharing your CVV, sharing only with trusted sources. Be proactive and well-informed about it to be able to experience the comfort of online shopping without losing one’s grip on financial safety.

You shall love: Major Types of Cross-Border Payments in 2024; Detailed Guide

FAQs

What is a Card Verification Value?

The Card Verification Value (CVV) is a three- or four-digit code printed on your debit or credit card, which, for purchase verification, assumes that one has the physical card during online or over-the-phone purchases to make the use of the card more difficult for fraudsters.

Where is the CVV on my debit or credit card?

For Visa, Mastercard, and Discover cards, the CVV is a three-digit code placed on the back of the card above the signature panel. With American Express cards, it is a four-digit number, on the front of the card, above the card number.

Is the CVV the same thing as the CVC?

Yes, the CVC and CVV are just the same. It is only that different card networks have it differently. On one hand, there is the full form of the abbreviation ‘CVV,’ which is Card Verification Value; on the other hand, CVC stands for Card Verification Code. Both a Short forms for the security code used to verify the cardholder’s possession of the card during online transactions.

Why do I need to enter my CVV for online purchases?

The CVV ensures that the person buying has the card in his hand. This allows you to prevent fraud against your number and expiration date if they are used without your consent. The CVV during bank card transactions provides an additional way to enhance security for online and phone purchases.

Can merchants store my CVV?

No, the card verification value must not be stored by merchants. This is one form of security for one’s self in case there is a breach into data. Since the CVV is considered a major security feature in preventing the unauthorized use of one’s card.

Can I safely use my CVV?

You should only share your CVV when you make a valid purchase through a merchant you trust. Never provide your card’s verification value to an unknown or suspicious source, as this can lead to fraud.

Can the fraud completely be avoided by the use of the CVV code?

While the CVV does add an extra layer of safety, this is not against all eventualities. Bad guys quite easily steal your card information from a phishing site or through other sleights of hand. However, without the verification value of the cardholder authentication, it becomes very tough for them to complete the entire transaction cycle.

Do follow us on Facebook and LinkedIn, to stay connected with us.