Bank sort codes are an important element in banking. Wiring details are essential for ensuring the right routing to a payment or transfer to some other bank account. This process is mandatory in the United Kingdom, Ireland, and South Africa. To be initiated in domestic or international money transfers, an individual must know what a bank sort code is, its importance, and how it is found. This all-inclusive guide is designed to explain what bank sort codes are, the banking system’s meanings, and how they can be found.

What Are Bank Sort Codes?

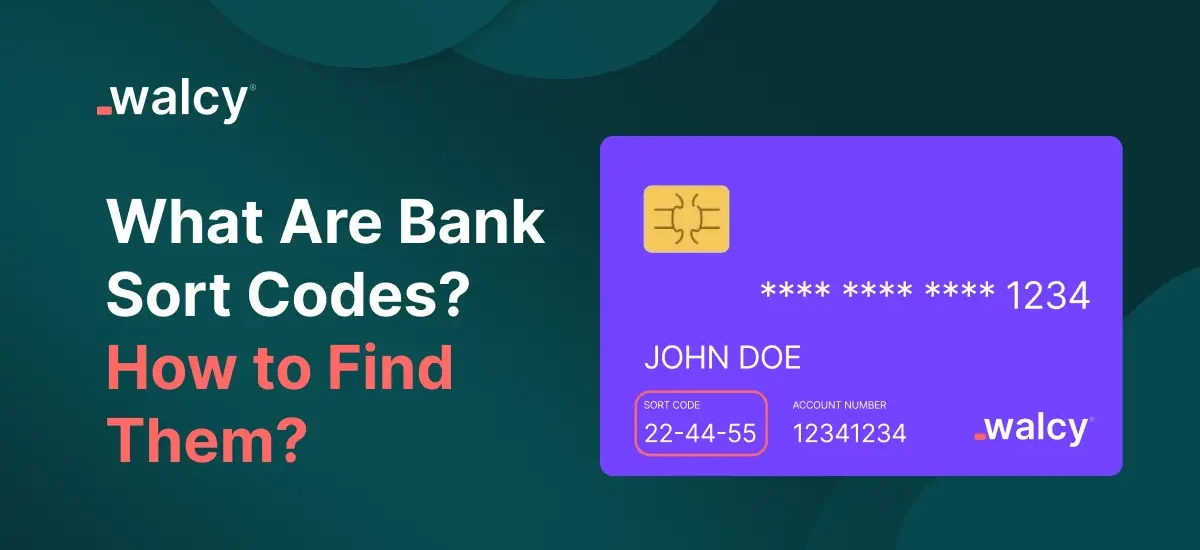

The bank sort code is a unique number; it is a six-digit number that supports the banking systems of countries, including the United Kingdom, Ireland, and South Africa. It identifies a certain bank, alongside the branches with which it is associated. The sort code primarily concerns the routing of payments within the banking network to ensure transactions are done effectively and without mistakes. A sort code will generally be in the shape of three-digit pairs, e.g., 12-34-56, in which each digit pair carries certain information about a bank and its branch.

The domestic sort code forms an integral part of the domestic banking infrastructure and is used in conjunction with account numbers to process a wide variety of financial transactions, including direct debits, wire transfers, and standing orders. Although their use is most widespread in the UK and Ireland, sort codes are also seen in other countries adopting similar banking frameworks.

Meaning of the Bank Sort Code

The meaning of the sort code of the bank is very vital in knowing for all those engaged in a transaction chiseling. Every part of the sort code carries significant information about the bank and the branch engaged in a transaction.

Bank Identifier: Normally, the first two digits of the sort code identify the bank. For example, a sort code starting with “40” may be used to identify HSBC or “20” for Barclays. These two digits indicate the financial institution where the account is held.

Branch Identifier: The last four numbers in the sort code are used to identify the branch of the bank. This helps the system in the process of routing the payment to the right location in that specific bank. Each branch has its number, which identifies and hence ensures the money gets to the right account within that specific branch.

Routing Information: The sort code forms important routing information within the banking network, which ensures that clearances are processed correctly to finally reach the right person or institution, without unnecessarily long delays. Routing accuracy is particularly important in such cases where the nature of the transaction may be time-critical, such as payroll or supplier payments.

In a more direct explanation, sort code is a method by which the banking system quickly and succinctly identifies the banks and their respective branches. This identification forms an integral part of the efficiency of any domestic payment, which significantly contributes to the financial system’s effectiveness.

Read about: What are IBAN Numbers and How Do They Work?

How to Find a Bank Sort Code

There are several ways to find this information; from seeking your sort code among the people to looking for yours in a bank.

Bank Statements and Cheque books: This is one of the easiest ways of getting to know your bank sort code through your bank statement or a cheque book. The sort code in most cases appears with the account number on either of the documents mentioned. It appears at the top or bottom of your statement in many cases.

Online Banking: If you have online banking, then you can easily locate your sort code online. Log in to your account and navigate to where it says ‘account details’. You will find your sort code there, along with your account number and other pieces of information. This method is so convenient because you can easily access your sort code at any time, even without carrying your physical documents with you.

Sort Code & Account Number Checker: Many online tools enable you to get a sort code for any bank and branch. Such tools, therefore, become very helpful, especially if you want to double-check a sort code against a payment or transfer. They provide an easy and quick way in which you can confirm if the sort code you have is correct, which reduces the scope for errors in your transactions.

Bank’s Website or Customer Service: Another reliable method of obtaining a bank’s sort code is through the use of the bank’s official website or by contacting customer service. Most banks maintain a generalized list of sort codes for all of their branches on their websites. Further, the customer service agent can assist you in finding the sort code in case of any difficulty in self-finding.

Payment Receipts: In case you have received any payments or direct debits from others, their sort code may be featured on the payment receipt or any transaction confirmation. This is a handy way of getting a sort code in case you want to refer to it in further payments or transactions.

How to Find a Bank by Sort Code and Account Number

Sometimes you may be required to find a bank with the use of a sort code and account number. This is of special importance in case you want to establish an account number to be genuine before you can make a payment, or to establish the bank details of an incoming payment.

There are several ways to look up a bank with a sort code and account number:

Online Sort Code Lookup Tools: A lot of online tools allow users to input the sort code first and then be issued with information about the bank and specific branch based on that particular code. Such kinds of tools are useful to verify bank details before transferring to another account. They check if the sort code and account number match a particular bank that you are trying to make a payment to and assure that there is no error.

Contact the Bank Directly: If you wish for a more secure route, you inform the bank with the sort code and account number details. Representatives of the banks can give you all the account details and confirm if the information is correct. This can be very helpful when you need to confirm that the account is real or you have suspicions about the information that was offered to you.

Sort Code & Account Number Checker: Several banks and other financial institutions offer sort code & account number checkers amongst their suite of customer services. It enables you to input a sort code and an account number and find out if it belongs to the right bank and branch. Handy when you’re making large transactions or setting up regular payments.

Websites and Financial Directories: Most banks have sort code directories prominently displayed on their websites, wherein one can search for a particular sort code to retrieve the branch details linked with it. Some financial directories and industry databases maintain quite detailed lists of sort codes with their respective banks listed against them, which helps in easily identifying the right institution.

More significantly, there always dawns a need to double-check the sort code with the account number just before a transfer is initiated to ensure that you have transferred funds to the right account. The one minute you take to check will mean no problems, and the money will find the right destination.

Sort Codes about IBAN and International Payments

Though sort codes find the primary application for domestic transactions within these countries, they are also the ones involved in international payments, mainly if paired with an International Bank Account Number (IBAN). IBAN is the system applied in a good number of countries spanning the globe, with users including users in the United Kingdom and European countries. This helps to process cross-border transactions.

An IBAN is an internationalized bank account number endowed with some identifier pieces, like a country code, check digits, bank identifier, and account number. The bank identifier of the IBAN usually provides the sort code in countries using sort codes. This makes it feasible for integration such that international payments will be directed properly around the global banking system.

Such a form would need an accurate IBAN and, where appropriate, a sort code for money to be processed without errors and delays, specifically when one is sending money to services such as Western Union and Revolut. For instance, when sending money to a UK bank account, Western Union would want the sort code to direct your funds to the proper branch.

This will ensure that international payments run efficiently and reach the correct destination. Understanding how these two elements are intertwined is crucial for anybody involved in financial, cross-border transactions.

Revolut Sort Code: A Case Study

Revolut is a well-established financial technology business. Offering a vast range of digital banking services and solutions, the company allows its users to perform international money transfers. You might be wondering how a sort code is applied to your Revolut account. In the UK, like any high-street bank, Revolut has assigned each account its own sort code and account number. It is possible to receive money directly into the Revolut account, direct debits, and standing orders.

The sort code on any Revolut account works just like that of any other sort code of a UK bank, and it will ensure the proper flow of payments. The user can sign in to the Revolut app, move to account details, and receive their sort code. It is important to use such information when setting up payments so that the funds are deposited correctly.

Knowing that Revolut is integrating sort codes into its digital banking platform, sort codes play an important role in the modern financial world. Although being a quite new bank, using sort codes guarantees its customers the same high level of safety and accuracy in transactions as with a traditional bank.

Need for Sort Code Accuracy

Sort codes must be accurately represented because a wrongly quoted sort code could mean loss or failure of payment, or money going to the account of another payee. It either caused delayed payments, problems with reconciliations, or loss of funds in some cases. Because of this, it’s very important to confirm both the sort code and account number before making a transaction.

If you are in doubt of the sort code, a check on the sort code and account number, or even a direct call to a bank with inquiries, will prevent making errors. In addition, businesses handling hundreds of payments daily would have verification processes in place that ensure all the sort codes and account numbers are double-checked for accuracy before the money is sent.

It’s a little effort on everyone’s part to verify the sort code before making the payment which can save innumerable hassles and also possible financial losses. A small step, a big difference. That’s all it can make toward the success of your financial transactions.

One would need to know what bank sort codes are and how to find them when one deals with financial matters, most especially within the UK and Ireland. The codes are entered as part of the six digits to guarantee that one’s payment will reach a specific bank branch and a smooth, precise transfer of finance.

Having the correct sort code is very crucial whether making domestic payments, setting up direct debit orders, or sending money to another country. You can use the methods recapped in this article to find any sort code you may need, including online banking, sort code checkers, and customer service.

Conclusion:

In a world that is getting more and more digital, where services such as Revolut and Western Union are revolutionizing how we handle money, sort codes have managed to hold their weight to the same degree. They signify a kind of backbone for domestic banking systems across many countries and form a vitally important facet that ensures funds reach their final destination securely and with ease. This will ensure that you have safe and successful financial transactions through the understanding of the role of sort codes and how you can find them appropriately.

Do follow us on Facebook and LinkedIn, to stay connected with us.