Those who have transferred money across borders must recognize SWIFT as the default transfer method. However, they might not have pondered how it functions, how the funds are processed, and the steps from initiation to fulfillment. Moreover, you also must not have much idea about the SWIFT alternatives.

As an early disclaimer, SWIFT does not process the transaction but instead sends payment orders between banks using unique SWIFT codes, also known as BICs (Bank Identifier Codes) and ISO 9362 codes. This establishes SWIFT as a standard that sends financial messages to its network of banks rather than a payment processor. The quest of this article is to understand the infrastructure and mechanisms behind SWIFT, detailing the entire process from the initiation of a payment order to its final fulfillment.

What is SWIFT?

SWIFT (Society for Worldwide Interbank Financial Telecommunications), established in 1973 in Belgium and operational since 1977, is deemed the standard for enabling interbank international payments. It is the default choice for sending money across borders and is a global messaging network that enables banks to conduct interbank financial transactions. More than 11,000 banks and financial institutions across 200 nations use SWIFT for messaging networks to communicate, and on average, more than 50.3 million messages are sent via SWIFT per day as of 2021. With a history spanning more than five decades, SWIFT is indeed deemed a reliable method.

However, like other legacy systems, SWIFT also has competitors that can disrupt it. With the advent of new technologies and innovations such as blockchain, API banking, matching processes, and regional payment standards like SEPA, SWIFT might not remain the status quo in the industry. Despite its deep heritage and reliability, SWIFT is accused of being slow for transactions, costly, and lacking transparency. To clarify further, a US $200 transfer takes 6.2% of the transacting amount, which is an expensive transaction fee.

Key Summary Points

SWIFT Overview:

-

- Established in 1973, operational since 1977.

-

- Global network for interbank financial transactions.

-

- Used by over 11,000 banks in 200 countries.

SWIFT Functionality:

-

- Facilitates communication between banks, not transaction processing.

-

- Uses SWIFT codes (BICs and ISO 9362).

SWIFT Code Breakdown:

-

- 8 or 11 characters: Bank Code, Country Code, Location Code, Branch Code.

Messaging Format:

-

- Different formats for various financial messages.

-

- Structured, precise, and encrypted for security.

-

- Universally accepted grammar (ISO standards).

SWIFT Process Steps:

-

- Multiple intermediary steps and processors.

-

- Messages are stored, acknowledged, validated, and securely routed.

Criticism of SWIFT:

-

- Time-consuming, less transparent, and expensive.

-

- Inefficiencies in transaction tracking.

-

- Subject to regulatory scrutiny and political sanctions.

5 SWIFT Alternatives:

-

- Card Networks: MasterCard, VISA for instant withdrawals.

-

- Blockchain Technology: Transparent information sharing.

-

- SEPA: Faster, cheaper Euro-based payments in Europe.

-

- International ACH: Cross-border transactions outside the US.

-

- Wise: Low-cost, fast, and transparent money transfers.

What Are Messages in SWIFT?

SWIFT messages contain the payment instructions between transacting parties, usually banks or financial institutions. SWIFT is not responsible for payment clearance, settlement, or even holding the transacting funds. Once the messages are transferred, the payment process is settled by the payment system. One major concept in SWIFT is correspondent banking accounts, which allow one to receive payments, make payments on behalf of financial institutions, and handle financial transactions based on bilateral agreements between two banking institutions. The message syntax is an industry-standard in financial messages, and SWIFT standards can be read and processed by many other financial processing systems.

SWIFT Revenue Sources

SWIFT is a member-owned cooperative with many financial institutions as its custodians. The members need to pay a one time fee as a joining and annual support charges where the amount differs based on the member classes. Furthermore, each message length and type incur charges, and these charges too vary based on the financial institution’s usage volume. It also offers bespoke services for fraud detection, sanctions screening and cybersecurity services for allowing companies for compliance and adherence to regulations.

Breakdown of a SWIFT Code

A SWIFT code is used to identify a financial institution for wire transfers and consists of 8 or 11 characters. Let’s dissect a SWIFT code of the following format: XXXXYYZZAAA.

- Bank Code (XXXX): The first 4 characters of the SWIFT code represent the bank code and consist of letters to identify the bank. For instance, for ICCI Prudential Bank, ICCI can be the bank code.

- Country Code (YY): The next 2 characters (YY) after the bank code (XXXX) represent the ISO 3166-1 alpha-2 country code and consist of letters used to identify the country where the bank is located. For instance, IN refers to India.

- Location Code (ZZ): The following 2 characters (ZZ) after (YY) represent the location code and consist of both letters and digits. It helps to identify the location of a bank’s head office to ensure the routing of the message is done correctly.

- Branch Code (AAA): The last 3 characters are optional and represent the branch code. If omitted, it typically indicates the primary office. It consists of letters and digits.

Let’s now take an example of a real BIC code using what we have learned. What would be the SWIFT code of the following Japanese bank, SUMITOMO MITSUI TRUST BANK, LIMITED, TOKYO, Japan?

SWIFT Code: STBCJPJTSAD

-

- STBC: It is the Institution or Bank code for Sumitomo Mitsui Trust Bank, Limited.

-

- JP: ISO 3166-1 alpha-2 Country Code for Japan is JP.

-

- JT: JT refers to the Location code for Tokyo.

-

- SAD: Optional branch code somewhere in Tokyo.

Messaging Format for SWIFT Messaging

One can imagine the SWIFT messaging protocol as a secret language for financial institutions to talk secretly with each other and prevent others from reading the message even if it is intercepted. Here is a layman’s description of the SWIFT messaging format:

Different Message Formats: SWIFT Messages come in different formats (MT1xx, MT2xx, MT3xx, and so on) depending on what financial message is required to be transmitted via the network. Some could be for payments, some for stocks, and others for bonds. Each format has its strict grammatical syntax and vocabulary.

Structured Message Structure: Every SWIFT message type has a distinct structure, akin to a fill-in-the-blanks form we generally see. There are compulsory fields that include generic information like sender and receiver info and optional fields if extra details are required.

Precise Format: Every bit of information in the message has a clear format to avoid confusion. Certain numbers might have a set number of digits and decimals, and text fields can have specified character limitations and allowance for symbolic characters.

Encrypted Delivery: Secrecy is the most important part of SWIFT messaging, and messages travel securely on a special encrypted SWIFT network. Only authorized users with secret credentials can access and understand the message payload.

Universally Acceptable Grammar: SWIFT messaging follows international messaging standards set by ISO 15022 and ISO 20022, which act as a common language for all banks for more interoperable communication. This ensures that everyone in the network understands each other clearly, regardless of geography and language barriers.

Redundant Checking: Before delivering a SWIFT message, it is checked and rechecked for accuracy and proper formatting. Some intermediary regulatory bodies also check the accuracy of the messages. This redundant checking helps mitigate hackers trying to transfer funds illegitimately.

Here is the sample SWIFT message format, however, for security reasons certain information has been redacted for privacy purpose and therefore is not an accurate representation:

| {1:F01YOURBANKXXXX2123456789} | (Basic Header: Sender info) |

| {2:I103RECEIVERBKXXXXN} | (Application Header: Receiver info) |

| :30:24062024 | (Date: Today’s date) |

| :52A:SENDERBK | (Sender Bank) |

| :57A:/B/1234567890 RECEIVERBK | (Receiver Bank account info) |

| :59:/987654321 John Boe | (Beneficiary info: Account number and name) |

| :70:Salary Payment for May 2024 | (Payment description) |

| :32B: USD10000.00 | (Amount and currency) |

| :71A:OUR | (Charges: Sender pays all fees) |

Infrastructure Diagram for SWIFT

Image Sourced from: https://blog.bytebytego.com/p/swift-payment-messaging-system

Image Sourced from: https://blog.bytebytego.com/p/swift-payment-messaging-system

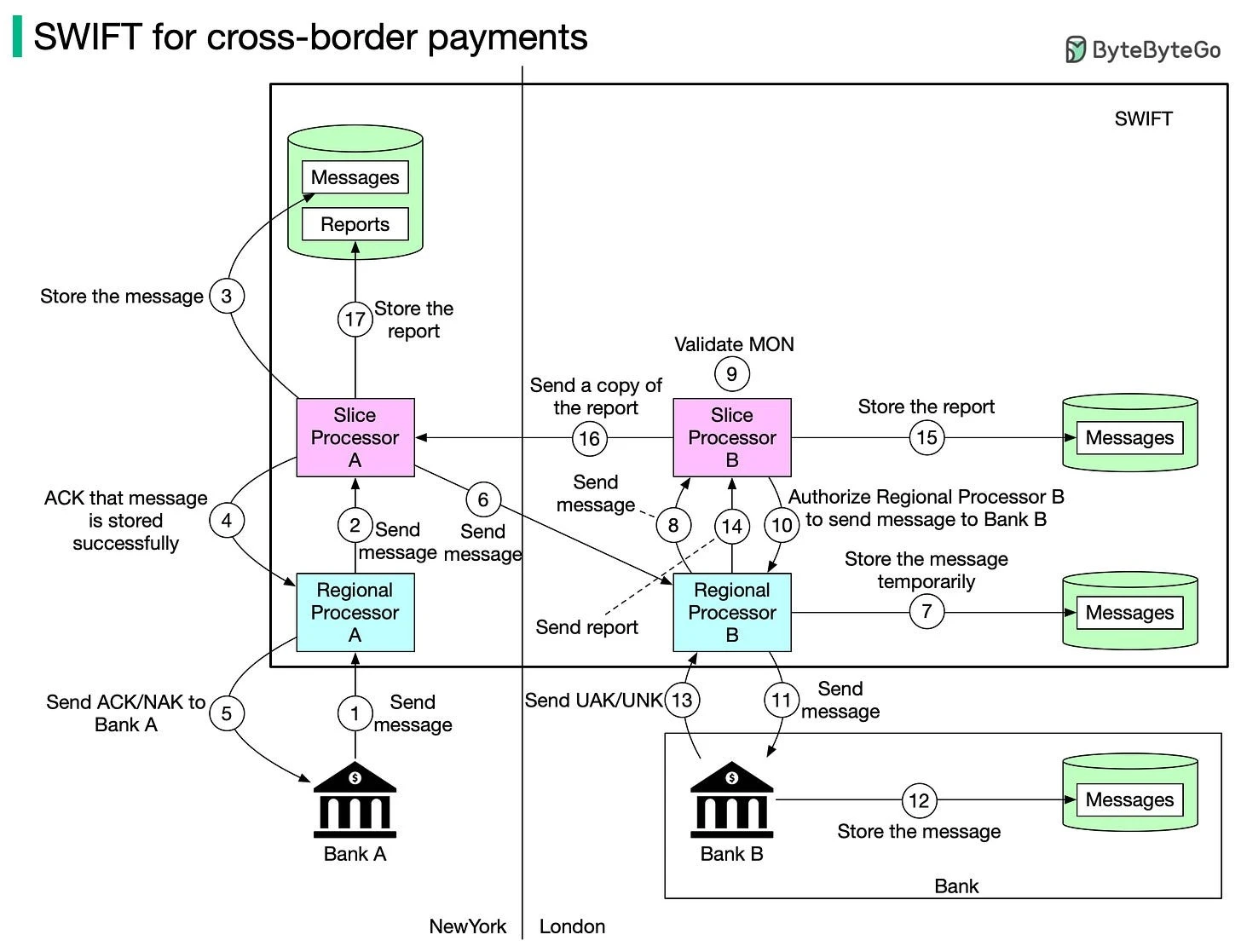

The diagram provided by Bytebytego depicts the SWIFT processes for international payments, involving multiple steps between intermediary banks and SWIFT’s processing units named regional processors. The steps are explained in sequence:

- Bank A sends a message: Bank A initiates a cross-border payment from New York to London by sending a message to its immediate regional processor A.

- Regional Processor A forwards the message: Regional processor A sends the message to slice processor A for processing immediately after receiving the message instruction.

- Slice Processor A stores the message: Slice processor A initiates a request to store the message in the SWIFT message database.

- ACK to Regional Processor A: Slice processor A sends an acknowledgement (ACK) signal back to regional processor A, confirming the message has been successfully stored in the message database.

- ACK/NAK to Bank A: The FIN Messages’ instructions are sent back to Regional Processor A. The Regional processor either sends an acknowledgement (ACK) or a negative acknowledgement (NAK) back to Bank A to indicate whether the message has been successfully stored.

- Send a message to Regional Processor B: Regional processor A sends the SWIFT message to regional processor B in the vicinity of London.

- Regional Processor B temporarily stores the message: The SWIFT message is stored temporarily in regional processor B’s message database.

- Send report: Regional processor B sends a report of the message to Slice processor B, akin to Processor A’s function in step 5.

- Slice Processor B validates the report: Report validity is done multiple times throughout the message transfer. Slice Processor B validates the report from Regional Processor B.

- Authorization to send a message: Slice processor B authorizes regional processor B to send the message to Bank B. The Slice processor’s main responsibility is storing and routing messages safely.

- Send the message to Bank B: Regional processor B sends the message to Bank B.

- Bank B stores the message: Bank B stores the message in its message database. The messages are stored redundantly so that later in case of an anomaly, the point of failure can be identified.

- Send UAK/UNK: Regional processor B sends a user acknowledgement (UAK) or user negative acknowledgement (UNK) signal back to regional processor A. This ensures whether the message was fulfilled or not.

- Authorize Regional Processor B to send a message to Bank B: Slice processor B authorizes Regional processor B to send the message to Bank B, repeating step 10.

- Store the report: The report is stored in the SWIFT messages database by Slice processor B. It is important to note that this time the report is stored, not the message.

- Send a copy of the report: A copy of the report is sent from Slice processor B to Slice processor A.

- Store the report: Slice processor A stores the report in the messages and reports database.

Criticism of SWIFT

The reasons why consumers are looking for other payment processing systems are as follows:

- Multiple Intermediaries: Since the messages pass through multiple intermediary banks before they reach the desired financial institutions, it makes the SWIFT network time-consuming, less transparent, and expensive. However, SWIFT has tried to make improvements to delivery duration and transparency with initiatives like SWIFT GPI (Global Payments Innovation). Swift GPI ensures that those payments that transcend borders should be processed within a few hours, and over 89% of payments are processed within an hour. Also, SWIFT Go was created to help with transferring low-value cross-border payments. Although SWIFT Go was also introduced to reduce the transfer time significantly, major banks could not connect to it due to the rigidity of their legacy banking systems.

- Inefficiencies with Transactions: The transactions are not verbose and there are no known ways to track the transactions’ status in real-time. This lack of transparency can cause errors and delays in the transactions.

- Active Transactions Scrutiny by Governments and Regulatory Bodies: Due to AML and CTF policies by regulatory bodies and governments, SWIFT transactions are subjected to strict scrutiny. This scrutiny hampers the integrity of the messages, and this might hinder certain other governments from using the SWIFT network. While the primary goal of scrutiny from regulatory bodies is to prevent illicit transfers, it has resulted in slowing down the transaction process. The delay is evident as the transactions are flagged for further review, and the review time may potentially cause delays in the fulfilment even for legitimate transactions. SWIFT has been used as a tool for political sanctions. For instance, Iranian and certain Russian banks from the network have been disassociated with the SWIFT network.

5 Best SWIFT Alternatives

Although SWIFT is combining real-time payments, API banking, and improved data analytics to enhance its service offerings and maintain its industry position as an industry leader, it is still far from making the necessary strides to compete with the following alternatives:

- International Card Networks: MasterCard and VISA allow for instant withdrawal of funds via ATM networks. However, the fees can be higher compared to SWIFT transfers. It can be used for purposes such as remittances, global payouts, payroll, etc.

- Blockchain Technology: Blockchain is an advanced database mechanism that uses distributed ledger technology for more transparent information sharing. It stores information in blocks called records and is linked together with cryptographic hash functions. It is these days considered as one of the better swift alternative for business. Blockchain technology’s gift to the financial sector is cryptocurrency. Bitcoin, Dogecoin, and Ethereum, three of the most popular currencies, are based on blockchain and utilize the peer-to-peer model to settle transactions and messages, ousting the need for SWIFT-like networks. Financial institutions can create their private blockchain network to manage funds without the need for SWIFT.

- SEPA: The Single Euro Payments Area, introduced in 2008 for credit transfers and in 2009 for direct debits, is a Euro-based payment system used throughout the European Union. Even though it is geographically restricted, for European nations, it is faster and cheaper than the SWIFT network. The Single Euro Payments Area (SEPA) consists of 36 European countries, including all 27 member states of the European Union and several countries that are not part of the European Union. Iceland, San Marino, Norway, Switzerland, Liechtenstein, Monaco, Andorra, Vatican City, and the United Kingdom are additional countries not part of the European Union.

- International Automated Clearing House (ACH): Also called Global ACH, this is an ACH payment that allows cross-border transactions outside the jurisdiction of the United States. Two primary conditions are mandated by a special rule that governs International ACH Transactions (IATs):

- Classification Requirement: Gateway Operators are required to recognize and categorize as International ACH Transactions (IAT) any payments sent to or received from financial institutions outside of the United States.

- Information Inclusion: The regulation further mandates that the processing paperwork contain comprehensive information on each party engaged in the ACH transaction.

- Classification Requirement: Gateway Operators are required to recognize and categorize as International ACH Transactions (IAT) any payments sent to or received from financial institutions outside of the United States.

- Wise: Wise, previously known as TransferWise, offers a low-cost, transparent, and fast international money transfer service, using mid-market exchange rates, small markup fees or flat payout fees per transaction, and utilizes a matching process where inbound and outbound transactions are matched for quick settlement of funds. It also allows one to use their mobile and web application to transfer funds and other tools to monitor transactions.

(Know about the fees involved in international money transfer)

Conclusion

In a nutshell, SWIFT remains a dominant force in global financial transactions due to its extensive network and historical reliability. However, its legacy infrastructure faces significant challenges from newer, more efficient technologies and regulatory scrutiny. The introduction of SWIFT alternatives like blockchain technology, and SEPA, and innovative services like Wise reflects a dynamic shift towards faster, cheaper, and more transparent financial solutions.

As the financial environment evolves, the need for more efficiency and reduced costs motivates institutions to explore these options, which might reshape the future of international money transfers.

Know more about SWIFT payment.

Know how to save money on international payments.

Sources for data

-

Swift FIN traffic & Figures, https://www.swift.com/about-us/discover-swift/fin-traffic-figures

-

Swift Payment, https://tipalti.com/payments-hub/swift-payments/

-

Swift Payment Messaging System, https://blog.bytebytego.com/p/swift-payment-messaging-system