There are several electronic funds transfer mechanisms in India, and there is general confusion about which kind of funds transfer mechanism is suitable for which use case. In the case of India, two of the most suited transfer systems are NEFT (National Electronic Funds Transfer) and RTGS (Realtime Gross Settlement). In this article, we will discuss NEFT vs RTGS, what each payment method entails, as well as a pedantic analysis of the pros and cons of both systems, mechanisms, and differences. Let us start with the definition of both systems:

What Is NEFT?

In operations since November 2005, it was set up by the Institute for Development and Research in Banking Technology to enable funds transfer between NEFT-enabled bank accounts on a p2p basis with 1:1 cardinality. It employs electronic messages for transaction processing, which are also called Financial Transaction Messages, and comply with the ISO standards for message formatting.

It is not immediate and processing of funds might take up to 2 days for the fulfillment of the transaction. Furthermore, RBI has fixed NEFT processing timings as 24/7, which was previously set to between 8:00 AM and 6:30 PM. Transfer fees range in value from Rs. 2.5 to Rs. 25, depending on the size of the transaction.

What Is RTGS?

Real-time transfer is not possible with NEFT which prefers net settlement over gross settlement, therefore, for a high-value payment or quick payment, RTGS is used which solves these problems. One of the important aspects of RTGS is that the transfer is near real-time, unlike NEFT. However, there are several limitations with RTGS as well, like minimum transfer, maximum limit per day based on retail internet banking or corporate internet banking, and a transaction window where one can initiate RTGS transfers.

Now, let’s deep dive into the mandatory information required for initiating both RTGS and NEFT transfers:

- Amount to be remitted via the payment system

- Beneficiary Bank details

- Beneficiary Name details

- Beneficiary’s bank account number

- IFSC code of the destination bank and branch

- Remit initiator or remitting customer’s account number

- Remitter to remittee information, if any

Any of the above information if not submitted, will result in the inability to transfer the funds, since the account number details are important. In the case of RTGS, account number verification is key. RBI suggests extra scrutiny over the account number as well.

Steps With NEFT Vs RTGS

This section will delve into the NEFT and RTGS processes and how they work. The steps are strictly streamlined and each stage is compulsory. First, we discuss the NEFT processes:

- The customer meets an application requirement by fulfilling the beneficiary’s details, including the beneficiary’s name, bank, branch name, IFSC, account type, account number, and the remittance amount, as aforementioned in the above section.

- The remitter can then authorize their bank branch to debit their account and initiate a transfer of the fixed amount to the beneficiary’s bank account. This service is also accessible via major online banking platforms, and some banks provide the NEFT facility through ATMs as well.

- The originating bank branch generates a financial transaction message and sends it to its pooling center operated by the NEFT Service Center. The message is then sent from the pooling center to the NEFT Clearing Center, which is managed by the Reserve Bank of India, Mumbai’s National Clearing Cell, in order to be included in the following batch that becomes available.

- The Clearing Center sorts the fund transfer transactions for the destination bank and prepares accounting entries to debit the originating bank and credit the destination bank one by one. Thereafter, bank-wise remittance or funds transfer messages are sent to the destination banks through their pooling centers (NEFT Service Centers).

- Finally, the destination banks receive the inward funds transfer messages from the clearing center akin to Financial Transaction Messages and credit the beneficiary customers’ accounts accordingly.

Now the RTGS funds settlement cycle goes through the following stages:

- The account holder or the remitter initiates the transfer by fulfilling the RTGS application, and requires the following details such as the sender’s account number, amount to be transferred, name of the beneficiary, IFSC (Indian Financial System Code) of the beneficiary’s bank branch, and beneficiary’s account number.

- The bank initiates the verification and authorization by verifying the details provided by the remitter and checks there is a balance available in the bank account covering the remit amount and applicable charges.

- The bank then transfers the funding instructions or messages to RBI as it facilitates the RTGS transaction in India. After this, the RBI processes the transfer request by transferring the amount from the sender’s account with the specified amount.

- The remitee’s bank account receives the funds from the RBI and credits it to the remitee’s account. The confirmation message is sent usually via SMS, email, or transaction notification in the banking portal.

- The entire process is completed usually within 30 minutes, and the credited funds can be immediately used by the remitee.

Limitations In Terms Of funds Transfer Threshold

RBI regulates both the RTGS and NEFT, therefore, it has the authority to impose thresholds per transfer. However, banks can also have their transaction limits.

First off, with a minimal limit of Rs. 2 lakh, RTGS is utilized for high-value transactions under RBI standards. There is no maximum limit prescribed by RBI for RTGS transactions, allowing banks to set their upper limits.

Secondly, for NEFT transactions, RBI has not set any minimum limit and the maximum limit was initially set by RBI at Rs. 10 Lakhs. However, banks can decide their maximum limits within this framework.

Key Statistics Related To NEFT and RTGS In India

NEFT Statistics

- According to Reserve Bank of India provided data the transaction volume of NEFT in Februrary 29, 2024 was 4.10 crore which is the highest ever. The volume of NEFT transaction if we analyse the data from 2014 to 2023, the transaction in case of volume have grown by 700% and in terms of value by 670%.

RTGS Statistics

- RBI’s RTGS managed to process its highest volume ever of 16.25 lakh (1.625 million) transactions in a single day on March 31, 2023.

- If we analyse the growth of RTGS, it has grown by 200% in terms of volume and 104% in terms of value according to the past decade’s data. Source: Reserve Bank of India.

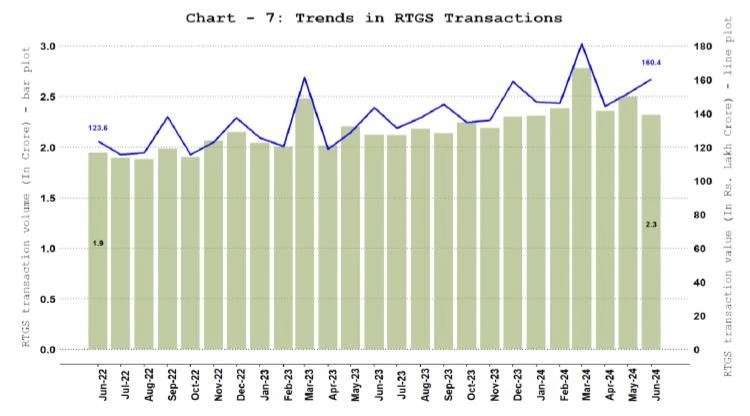

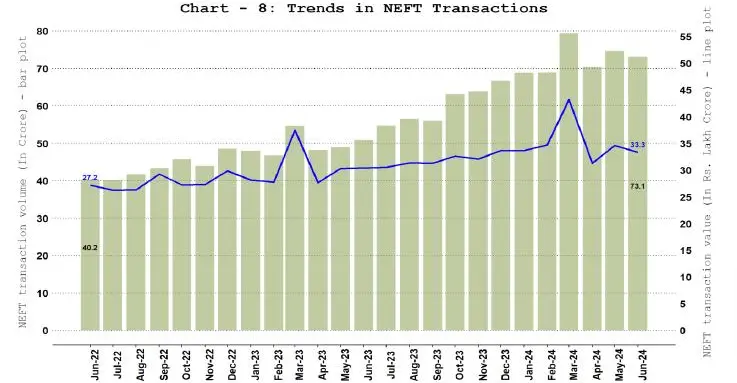

In the pictorial representation of trends in payment systems webpage from RBI, the following charts can be obtained in the following URL: https://rbi.org.in/Scripts/TrendsPSIUserView.aspx?Id=31

If we account for volume stability, RTGS shows amazing stability with slight variance over the observed period starting from June 2022 till June 2024, and the growth is also stable throughout the period. In terms of value volatility, we can see that during the month of February for both 2023 and 2024, we can observe considerably high-value transactions requiring immediate settlement.

Similarly, for NEFT, there is a clear upward trend in terms of the volume of transactions, and the growth rate for NEFT is also consistent. This reflects that there is a growing trust and reliance on the NEFT system.

The comparative insights from both charts are that RTGS has maintained a stable transaction volume because of its high-value transaction nature, whereas NEFT exhibits a rising trend. This difference highlights the distinct use cases for each system, with NEFT becoming more popular for everyday low-value transactions. Furthermore, both RTGS and NEFT experience value peaks in February 2023 and 2024, suggesting a period of increased financial activity.

You shall love to read: Cross-Border Payment Solutions: Past vs. Present vs. Future

Summary Differences Between NEFT and RTGS

| Points | NEFT | RTGS |

| Transaction Limitations | No set minimum and maximum limits set by RBI | Minimum 2 Lakhs with no Maximum limitation |

| Governed and Operated by | RBI | RBI |

| Transaction TAT | Up to few days, with deferred settlement | Immediate and less than 2 hours |

| Payment Options | Both offline and online medium available via banking branches and web portals. | Both offline and online medium available via banking branches and web portals. |

| Suitable for | Low-value payments with no time-sensitivity | High-value payment requiring immediate settlement |

| Operational Hours | 24/7 as per new RBI guidelines with hourly batches | 24/7 available via bank’s web-portal |

| Fees | Ranges from ₹ 2.5 to Rs ₹ 25 based on the volume of transfers. | No charges for inward transaction and online transaction, however, for outward transaction up to Rs 55* |

| Settlement | Net settlement in batches | Gross one-to-one settlement, and immediately. |

As per the above table, NEFT and RTGS payment systems are governed and operated by the Reserve Bank of India (RBI) for electronic payment processing. NEFT, a clearing system, is suitable for low-value payments without time sensitivity, with no set minimum and maximum threshold by the RBI. Interestingly, NEFT supports both offline and online payment options via banking branches and web portals of the remitter’s bank.

When it comes to settling the transaction, the transactions are settled in batches, resulting in a transaction turnaround time (TAT) that can take up to a few days with deferred settlement. Operational hours for NEFT are 24/7 as per new RBI guidelines, with transactions processed in hourly batches. Finally, the fees incurred for NEFT transactions range from ₹2.5 to ₹25, depending on the volume of transfers.

In contrast, RTGS is designed for high-value payments requiring immediate settlement, with a minimum transaction limit of ₹2 lakhs and no maximum limit. Like NEFT, RTGS also supports both offline and online payment options through banking branches and web portals. The transaction TAT for RTGS is immediate, usually within less than 2 hours. RTGS operates 24/7 via the bank’s web portal, allowing continuous transaction processing. While there are no charges for inward and online transactions, outward transactions can incur fees of up to ₹55. Settlement in RTGS is gross and on a one-to-one basis, ensuring immediate transaction completion.

Conclusion

In conclusion, both NEFT and RTGS are the important components of India’s electronic payment ecosystem, governed by the RBI, necessary for boosting India’s digital payments adoption rate and financial inclusion. Though NEFT transaction is suitable for low-value, non-urgent transactions, with a more extended processing time and lower fees, it is the adopted faster as a transfer medium than RTGS transaction.

On the other hand, RTGS caters to high-value, urgent transactions, offering immediate settlement but with higher potential fees for outward transactions, the trend analysis shows that the adoption rate is stable and growing. Understanding these differences can help users choose the right method for their specific needs.

Get to know about the international payment fees | Know everything about the overseas payments | Know about RTGS transfer in detail.

Do follow us on Facebook and LinkedIn, to stay connected with us.