One of the major actors in global financial operations is the Society for Worldwide Interbank Financial Telecommunication or SWIFT.

Financial institutions may send and receive information about financial transactions consistently and effectively using the secure infrastructure that SWIFT offers.

SWIFT message types are crucial to the system, allowing seamless communication by banks and other financial organizations.

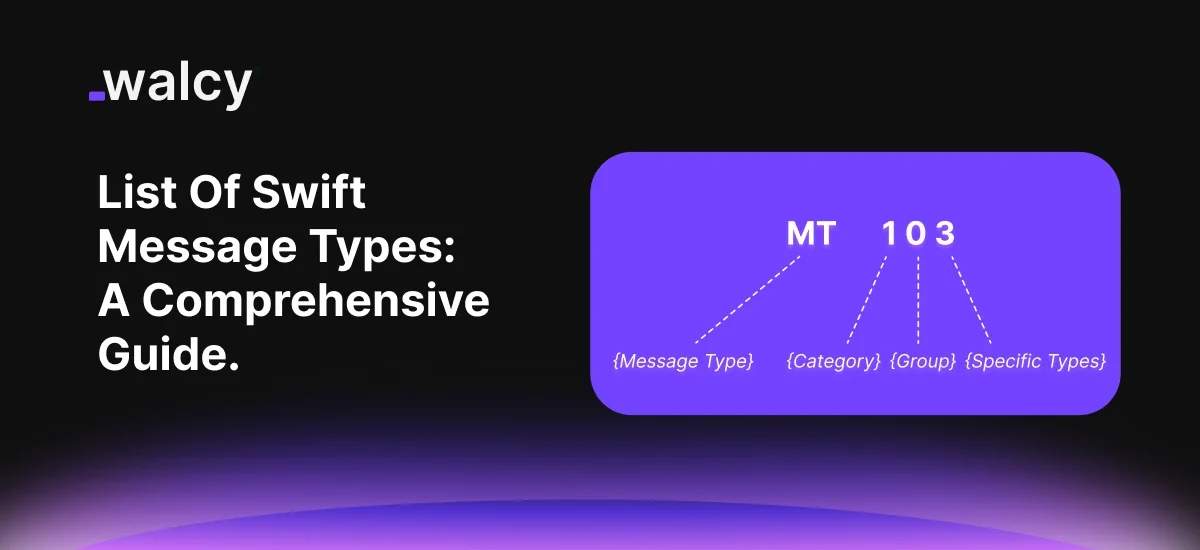

In this article, we examine SWIFT message types, including categories, structures, and particular examples such as the MT 202 SWIFT message and the MT103 format SWIFT.

We will explore how these messages work in a greater context of MT and MX payments.

What Are SWIFT Message Types?

SWIFT message types are a standardized set of messages banks and financial institutions use for the secure and efficient conduct of business.

Every different message type serves some purpose and, thus, is grouped by category based on the type of transaction or information it intends to convey.

They ensure consistency, minimize errors, and speed up the pace of global financial communications.

These messages are fundamental for cross-border payments, trade finance, and securities transactions, among other operations.

SWIFT messages are categorized mainly into two groups:

MT (Message Type) Messages:

- Used in traditional financial transactions.

- Commonly utilized in the areas of payment, treasury, securities, and trade finance.

- Are limited to text-based formats with field lengths pre-defined.

MX Messages:

- XML-based; used in most ISO 20022 standards.

- Most flexible and rich in data compared to MT messages.

- Allow more comprehensive and detailed financial data that enhances compliance and reporting.

How SWIFT Messages Are Structured

A specific format is attached to each SWIFT message type, and such a format consists of predefined fields containing essential details about any underlying transaction.

Such fields guarantee uniformity and accuracy in financial communication and thus allow the institutions involved to process transactions both efficiently and with minimal errors.

The standardized structure also makes automated processing and regulatory compliance feasible, therefore making it an indispensable tool in global finance.

The basic breakdown of the structure:

-

Header Block:

It contains metadata, including type, priority, and details of the sender/receiver.

It contains the quintessential routing information that helps to ensure the message arrives at the appropriate destination.

-

Text Block:

It comprises account numbers, transaction amounts, currency, and payment instructions, among others.

This section constitutes the major chunk of the message since it will define the purpose of and the nature of the transaction.

-

Trailer Block:

This contains security and authentication information, including digital signatures and message checksums, that make sure the message integrity and authenticity are achieved.

Each block plays an essential role in maintaining security, efficiency, and reliability for the SWIFT network.

Thus, it reduces many errors and enhances trust among financial institutions.

Read about: SWIFT Alternatives For Businesses For Crossborder Payment.

Types of SWIFT Messages

Herewith is an overview of some common SWIFT message types, categorized by how they are used:

- MT Messages for Payments

- MT103: Single Customer Credit Transfer

- MT202: Financial Institution Transfer

- MT Messages for Securities

- MT540: Series to MT548: Trade, Settlement, and Confirmations

- MT Messages for Trade Finance

- MT700: Series to MT799: Letters of Credit and Guarantees

- MT Messages for Treasury

- MT300: Foreign Exchange Confirmations

- MT320: Loan/Deposit Confirmations.

- MT Messages for Cash Management

- MT940: For account statement reports.

- MT942: Real-time balance and transaction update.

- MX Messages

- Focused on ISO 20022 standards, high-value payments, securities, and trade finance.

Key SWIFT Messages Explained

-

MT103 Format SWIFT

The MT103 represents a standard message type that is used for single-customer credit transfers.

It is widely utilized for international wire transfers and thus forms an important part of global financial communication.

Key Fields in MT103:

- Field 20: Transaction reference number.

- Field 23B: Bank operation code.

- Field 32A: Value date, currency, and amount.

- Field 50: Ordering customer details.

- Field 59: Beneficiary customer details.

MT103 messages hold the key to ensuring funds are delivered with speed and accuracy to the intended recipient.

-

MT 202 SWIFT Message

MT202 is a message usually used for transfers between financial institutions. Unlike MT103, which handles customer transfers, MT202 deals with bank-to-bank transactions.

Key Fields in MT202:

- Field 20: Transaction reference number.

- Field 21: Related reference.

- Field 32A: Value date, currency, and amount.

- Field 52A/53A/54A: Correspondent bank details.

- Field 58A: Beneficiary institution.

MT202 is essential to settle interbank obligations and manage liquidity.

-

MT and MX Payments: A Comparison

The migration from MT to MX messaging is one of the most dramatic changes in the history of financial messaging:

- MT Payments:

- Text-based messages

- Maximum character limit of 6,000

- Deployed primarily in legacy systems

- MX Payments:

- XML-based, data-rich

- More flexible and can hold a host of complex details in each transaction

- Adheres to ISO 20022 standards, ensuring alignment with projects such as SEPA and SWIFT gpi.

Benefits of MX Messages

- Better Data Quality

MX messages employ the ISO 20022 standard to support more structured and more detailed data fields. The result is fewer errors and ambiguities, making sure that any critical transaction information is well-defined and accurate.

- Richer Data Formats for Value-Added Payment Processing

MX message formats provide a comprehensive description of each transaction. This facilitates enhanced tracking of payments by the banks and financial institutions that are involved, while also promoting better visibility for both sender and receiver.

- Better Compliance with Regulations

The ISO 20022 standard provides the ability for financial institutions to carry extensive regulatory and compliance-related information. This makes it easier to adhere to international standards and makes reporting to regulatory bodies less complex.

- Increased Automation and Efficiency

The structured format of MX messages supports automated processing, reducing the need for manual intervention. This enhances operational efficiency and minimizes the risk of human error in financial transactions.

- Improved Interoperability

MX messages are designed to be compatible with various financial systems globally. This allows for seamless communication and data exchange across different platforms and institutions, further facilitating smoother cross-border transactions.

- Future-Ready Infrastructure

The adoption of MX messages positions financial institutions to align with future technological advancements and regulatory changes. This ensures their systems remain up-to-date and capable of handling evolving market demands.

- Support for High-Value Payments

MX messages are especially advantageous for high-value transactions, requiring precision and richness of data. They make large-scale financial operations more reliable and secure.

- More Flexibility in Data Usage

The XML-based format of MX messages allows additional data elements to be added. This flexibility enables everything from simple payments to more complex trade finance transactions.

The Role of SWIFT Message Fields

Each SWIFT message type has specific fields pre-defined for capturing essential transaction information.

These fields ensure consistency, accuracy, and efficiency across global financial communication.

Being able to understand and use these fields correctly is so crucial to the smooth processing of payments and other financial transactions.

An error in field data from one or more of those could mean delays, additional costs, or regulatory non-compliance.

Common Fields in SWIFT Messages

Transaction Reference Number (Field 20)

A unique identifier is given to a transaction, this field assists in tracking and reconciling payments. It ensures that all parties involved can reference the transaction accurately, reducing the risk of miscommunication or duplicate entries.

Value Date, Currency, and Amount (Field 32A)

This field provides the settlement date, the currency, and the transaction amount. The information should be accurate here for timely settlement and to avoid discrepancies in financial records.

Ordering and Beneficiary Customer Information (Fields 50 and 59)

Field 50 provides information on the ordering customer, whereas Field 59 provides information on the beneficiary customer. Proper completion of these fields will help ensure that the funds will be credited to the right party and prevent misrouted payments.

Bank Operation Code (Field 23B)

This field identifies the type of transaction, like a credit transfer, payment, or direct debit. Proper identification of the transaction type ensures the payment is processed as intended and in accordance with regulatory and operational requirements.

Remittance Information (Field 70)

Provides additional information or instructions about the transaction, such as invoice numbers or the purpose of payment. This aids the receiver in reconciling the payment with their internal records for better transparency and communication.

An accurate population of these fields minimizes errors and ensures that funds reach the intended recipient without delay. Additionally, it supports compliance with international financial regulations and facilitates smoother transaction processing across borders.

How SWIFT Messages Drive Global Transactions

SWIFT messages ease international payments by providing a secure and standardized way for financial institutions to communicate. They ensure consistency, reduce errors, and provide real-time status updates, thereby making global transactions more efficient and reliable.

They are crucial in the following areas:

Cross-Border Payments

MT103 messages serve for single customer credit transfers, which allow individuals and companies to transfer funds easily and efficiently in different countries. They ensure clarity of payment instructions and that the funds will be credited to the correct recipient quickly, even in multi-bank scenarios.

Read about: Best Multicurrency Account: What Is It And How It Works?

Liquidity Management

MT202 messages are crucial for interbank settlements, which enable banks to manage their liquidity by transferring funds from one institution to another. These messages ensure that financial institutions maintain adequate reserves and fulfill their payment obligations without delays, reducing the risk of payment failures.

Read about: Understanding Liquidity in Banking; Detailed Guide

Trade Finance

SWIFT messages, such as MT700 for the issuance of letters of credit and MT760 for guarantees, support trade transactions with secure and reliable documentation. They allow seamless coordination between buyers, sellers, and financial institutions to ensure that payments and goods are exchanged as agreed.

Real-Time Tracking of Payments

SWIFT’s gpi service increases transparency because it offers real-time tracking of payments. This will increase confidence and satisfaction among financial institutions and their customers by letting them see the status updates of a transaction.

Compliance with Regulations

SWIFT messages easily allow the inclusion of a lot of detailed regulatory and compliance information to make the transactions meet international standards. In this respect, it contributes to AML efforts and adherence to sanctions, hence helping financial institutions avoid penalties.

Read about: What Is Money Laundering? Definition, Types And Examples.

Conclusion

SWIFT message types are the backbone of global financial communication.

From the widely used MT103 format SWIFT for customer transfers to the MT 202 SWIFT message for interbank transactions, these standardized messages ensure seamless and secure transactions across borders.

As the financial world keeps on changing, the transition from MT to MX messages and the adoption of ISO 20022 standards promise to bring efficiency, quality of data, and transparency to international payments.

Being informed about SWIFT message types and their specific usage helps in strengthening the confidence of business houses and financial institutions while they are operating worldwide.

Read about: All About Overseas Payments (2024) – Comprehensive Guide

FAQs

- What is the difference between MT and MX payments?

MT messages are text-based and of limited data capacity, whereas MX messages are XML-based and thus provide greater flexibility with richer data for modern financial transactions.

- For what does an MT103 SWIFT message stand?

MT103 is applied for a single customer credit transfer and is usually used for international wire transfers.

- What is the purpose of the MT202 SWIFT message?

MT202 facilitates bank-to-bank transfers and thus is widely used for settling interbank obligations.

- Why is ISO 20022 important for financial messaging?

ISO 20022 provides a global standard for financial messaging, allowing for more informative data, better compliance, and more transparency in transactions.

Do follow us on Facebook and LinkedIn, to stay connected with us.