In banking, one needs to know various codes for seamless transaction processes, particularly when making domestic or international payments.

One of the most important codes for banking is the BSB code.

This blog post explains what the BSB code is, its importance, and how it compares to other banking identifiers such as the SWIFT code, IBAN, and routing numbers, and also where you can find it.

What Does BSB Mean in Banking?

BSB stands for Bank State Branch, and it is a six-digit number used in Australia to identify a particular bank branch.

The code is unique and is normally imperative when processing domestic bank transfers for correct transactions to the right bank and branch.

It is the identification doled out to every bank branch for routing purposes of domestic payments within Australia. Correspondingly, in the United States, there’s a system called the routing number used to identify not only the bank but also where exactly it is located.

The BSB code allows all types of payment transfers, personal or business, to be made with efficiency and be assured that money ends up precisely where it has to go around Australia, without delays.

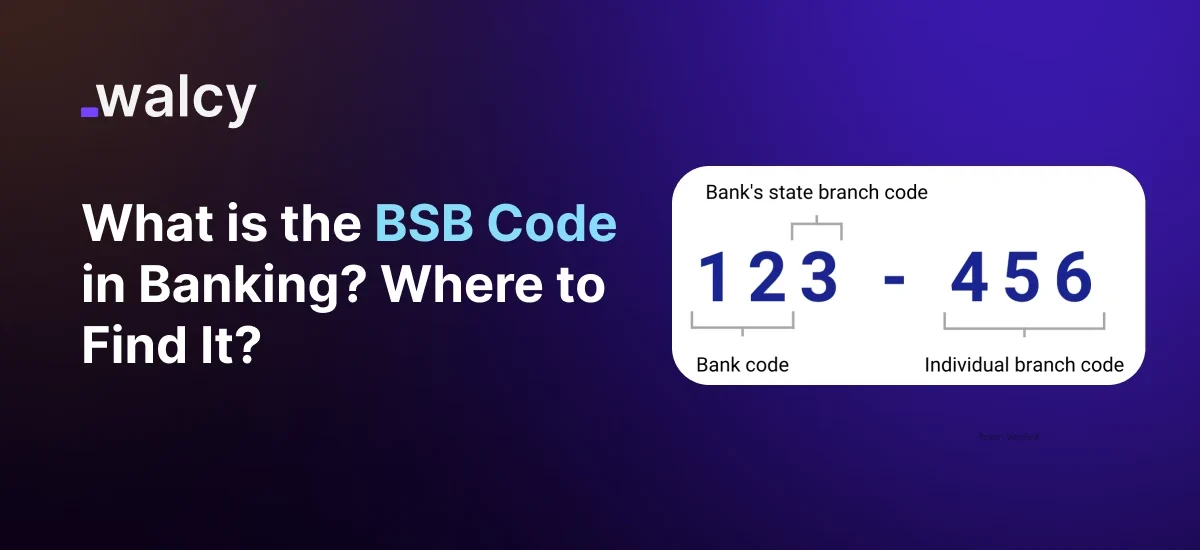

What Does a BSB Code Look Like?

A BSB code is just a Bank State Branch code-that six-digit code used in banking in Australia to sort out which bank and branch one is dealing with. It is the humane way of sorting payments properly, combined with the bank account number of the recipient.

BSB code format goes XXY-ZZZ, where

The first two digits identify the bank or financial institution: XX represents the bank or financial institution.

- The third digit identifies the state in which the branch is located: Y stands for the state where the branch is located.

- The last three digits identify the address of the branch: ZZZ is the branch’s specific address.

Now, let us look into the breakdown, 082902 belonging to NAB Bank:

- 08 says it is NAB.

- The third digit is 2, telling what territory (that is, state) the branch is in; in this case, it is the Australian Capital Territory.

- The last three digits, 902, indicate the branch’s address: Canberra City branch of NAB.

This helps prevent mistakes in a transaction that might result in domestic payments in Australia going to the wrong bank, branch, or even account.

Where Can You Find Your BSB Code?

Locating your BSB code is relatively easy, and one can do so through the following ways:

- Bank Statements: It can be found on your bank statement. It will probably be adjacent to your account number.

- Online Banking: If you are using online banking, it is easy to access and is usually displayed with other account details.

- Bank Branch/Customer Service: You can contact your bank or simply walk into one of its branches and then inquire about the BSB code. The staff may ask some questions for verification purposes.

- Cheque Book: If you still use cheques, then your BSB number is there on each of them. It is normally at the top.

- Bank Websites/Mobile Apps: Most of the banks have a code lookup facility on their website or through mobile apps. You just need to select your bank and branch location, and you will get the BSB code.

Importance of the BSB Numbers

The BSB numbers has relevance to Australian domestic payments. Here’s why:

Transfer Accuracy: The BSB number ensures that the payments go directly to the proper bank and its branch. In any transaction, if there is an inclusion of an incorrect BSB code, then a certain transaction may be delayed due to that factor or get transferred to a destination, further leading to a certain error in the processing of the particular transaction.

Smoothening Local Payments: Whether it is payroll payments, bills, or receipt of money, the BSB number makes sure that the transaction goes as smoothly and efficiently as possible, guiding the money to its proper destination.

Required for Direct Debits and Wire Transfers: Because with any domestic transaction in question say, a direct debit or wire transfer within Australia BSB code becomes required together with the account number to carry out the payment.

Fast processing: Once a BSB code is available, identification of the proper branch within which a bank should route payment will be easy, thus offering speed in the process with minimal delays.

How Does a BSB Work?

When initiating a domestic transaction within Australia, such as transferring money between two Australian bank accounts, the BSB code comes into play. The BSB identifies the specific bank and its branch where the recipient’s account is held to ensure proper routing of the transaction in the Australian banking network.

The BSB code works together with the account number of the recipient in every transaction to perform a sort of double-check for funds disbursement, therefore serving to minimize accidental mistakes.

While the BSB code may be accurate, it directs your money through appropriate financial channels, even between different banks or branches, to complete the transfer process. Whether it is a personal transfer, business payment, or direct debit, the BSB code permits a smooth and efficient transaction process, hence accelerating and making domestic payments more reliable.

This system will ultimately allow the Australian banking network to handle a large volume of payments with great accuracy.

BSB Number vs. SWIFT Code

The BSB number is used domestically, within Australia for domestic transfers, while the SWIFT code is employed for Society for Worldwide Interbank Financial Telecommunication international money transfers.

A SWIFT code is a unique alphanumeric code that identifies a bank during international transactions. It directs the money internationally to the right bank, just like the BSB directs the payments locally in Australia. Where international transactions are concerned, the SWIFT code and BSB code may both be used to get the money to the correct branch.

- BSB Code: Domestic payments within Australia.

- SWIFT Code: International transfer between nations.

BSB Number vs. Routing Number

The routing number is a nine-digit number utilized in the United States to identify a certain bank during domestic transfers. In Australia, it could be thought of as like the BSB number, whereby a routing number ensures that payments are transferred to the correct bank branch within the U.S.

While they serve for the same purpose, bank, and branch identification, the BSB number serves in Australia, while the routing number is used in the United States for local transfers.

- BSB Code: This is the Australian identifier for domestic transfers.

- Routing Number: This is the U.S. identifier for domestic transfers.

BSB Number vs. IBAN

The IBAN is an internationally used bank account number, mainly used in Europe for cross-border payments. It contains information about the country, bank, and account number and makes cross-border payments internally within those countries using the IBAN system easier.

Australia does not participate in the IBAN system for its banking network. Australian banks use SWIFT code banks to transfer money internationally, whereas BSB numbers are used for local-area payments.

- BSB Code: This is a code used within the domain of Australia to make local payments.

- IBAN: Used when carrying out international transfers between countries involved that support the IBAN system.

Conclusion

The BSB code is essential in the Australian banking system for domestic transactions to reach their bank branch recipients.

Whether paying bills, sending money to a friend or family member, or engaging in business, one should have his or her BSB code. It works with other international identifiers like the SWIFT code, routing number, and IBAN, each playing its role in global banking.

FAQs

- What is a BSB Code?

A six-digit number, the BSB code is used in Australia for identifying bank and branch details where the transfer must be addressed.

- How do I find my BSB code?

You can check your BSB code through your bank statement, via internet banking, by calling your bank, or within your checkbook.

- Is the BSB code different from the SWIFT code?

In Australia, the BSB code has authority, but mainly for local transactions, while the SWIFT number is used for international money transfers.

- Could one use the BSB code to make overseas transfers?

For international transfers into Australia, the recipient may need both the SWIFT and BSB codes to correctly route the money to the bank’s doorstep.

- Are BSB codes routing numbers?

No, the BSB code is utilized within Australia, while the routing number is within the United States. Both perform the same function, which is to locate a bank branch for local payments.

Do follow us on Facebook and LinkedIn, to stay connected with us.