The money transfer mechanism known as RTGS transfer enables the gross and real-time processing of securities and balance transfers between two or more different banks. Gross settlement denotes a one-to-one settlement that does not include bundling or netting with any other transactions.

Today we will discuss in depth everything related to RTGS money transfer including, benefits, limits, and charges.

What is RTGS Money Transfer?

RTGS money transfer is the electronic technique of transferring high amounts of money from any bank account to another bank account in no time. It deals primarily with transactions that need processing and settlement in real time without any delay. RTGS system is maintained by the country’s central bank. In other word RTGS transfer is the act of transferring the balance from one bank account to another via an RTGS system. It is an efficient and safe process for money transfers in a huge amount, and common use is made by businesses and individuals when there is a need for transactions in high amounts.

How Do RTGS Payments Work?

RTGS payments are high-value transactions developed individually and quickly through the RTGS system. These kinds of payments are majorly used for transactions where there is urgency and the amount involved is large, requiring quick settlement. The minimum amount that we can transfer using RTGS is usually high and often decided by central banks. For example, the minimum amount for an RTGS transaction in India is INR 2 lakhs. There is no upper limit for transfer under RTGS, so it is quite conducive for large-value transactions.

What is Fast NEFT or RTGS?

Fast NEFT or RTGS are both electronic payment systems. Whereas the NEFT runs the transactions in batches and mainly settles them in hourly gaps, on the other hand, RTGS processes those transactions that need instant clearance.

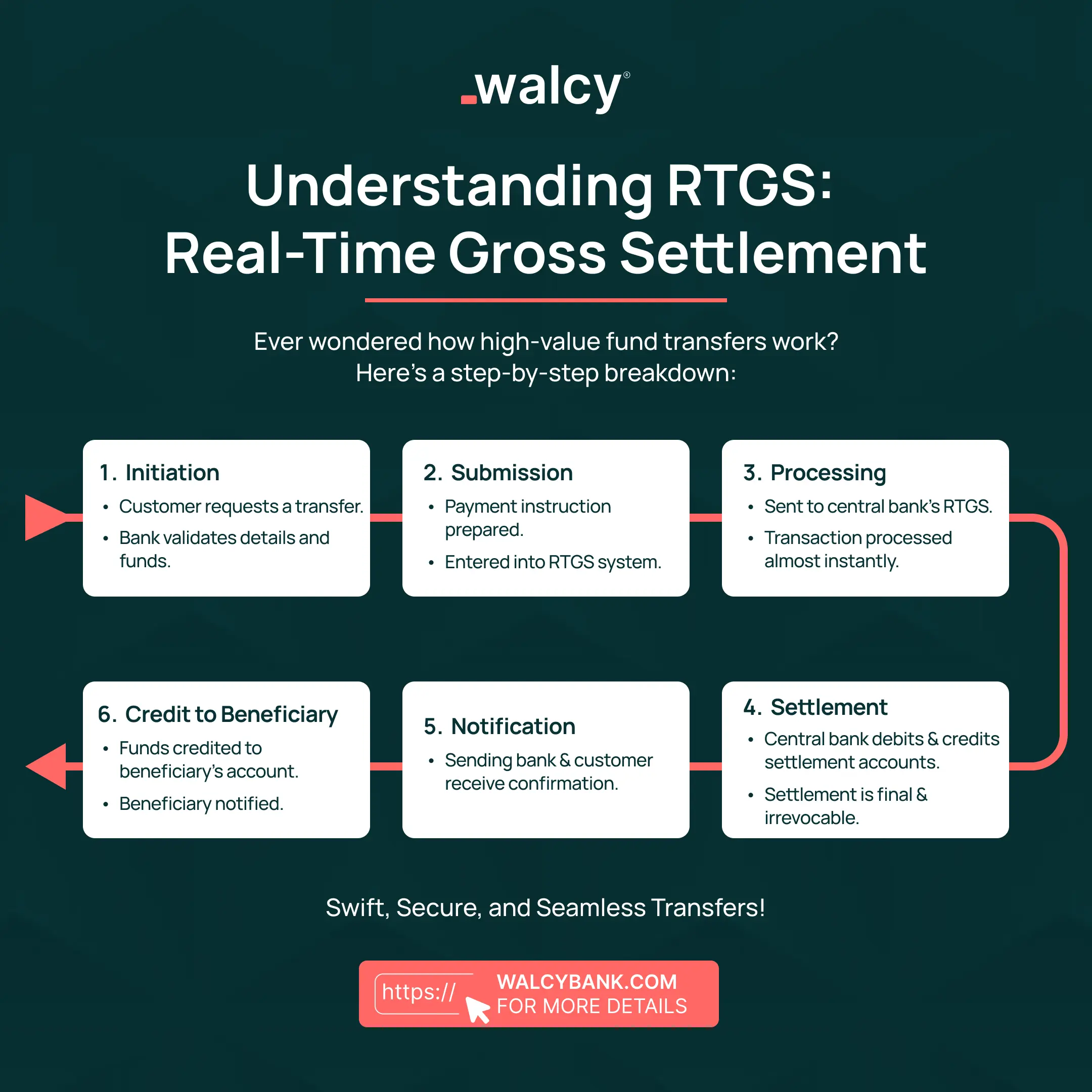

How Does a RTGS System Work?

The RTGS system refers to the continuous settlement of balances separately on an order-by-order basis. Once the process starts, payments are final and irrevocable. The system is very important in cutting down the settlement risk in the financial system since transfers are settled instantaneously after they are made.

Below is information that is mostly required to perform an RTGS transfer:

- Beneficiary’s Name: The name of the person or unit to whom the balance is being transferred.

- Beneficiary’s Bank Account Number: The bank account number into which funds have to be deposited.

- Beneficiary’s Bank IFSC Code: The Indian Financial System Code, IFSC, is an important key for identifying a particular bank branch.

- Amount to be transferred: The same fixed amount as you wish.

- Purpose of the Transaction: Some banks may require the purposes of the transfers.

While RTGS is firstly a domestic transfer medium, many countries have similar systems for international transactions, mostly involving their central banks or maybe using services like SWIFT for cross-border payments. International RTGS transfers may involve extra fees and need more information for e.g. the swift code of the beneficiary’s bank.

What Are The Charges For RTGS Transfer? What Else is Required?

The RTGS transfer charge may differ from bank to bank and by country regulations. Normally, banks can charge a fee for sending balances through RTGS, especially for higher amounts. For example, in India, some banks may charge a nominal fee for transactions above INR 2 lakhs, but most of the central banks and monitoring authorities encourage minimal charges to promote electronic payments.

Benefits Of RTGS Money Transfer

Speed and Efficiency

RTGS Transactions are processed in real-time ensuring quick transfer of balance. This is particularly beneficial for urgent payments and large-value transactions that need quick settlement.

Security:

RTGS transactions are highly secure due to stringent regulations and monitoring by central banks. Each transaction is processed individually, reducing the risk of fraud errors.

Final and irrevocable:

Once an RTGS transaction is processed, it is final. There is no possibility of reversal. This confers certainty and minimizes the possibility of payment defaults.

High-Value Transactions:

RTGS is ideal for high-value transactions. Often there is no high-value limit on the amount, that can be transferred. This market is suitable for corporate and business payments.

Reduced Settlement Risk:

This avoids unsettled growth of the transactions, as all the transactions are settled individually and immediately, reducing settlement risk in the financial system.

RTGS vs. Other Payment Methods

RTGS vs. NEFT

- Processing Time: RTGS is real-time, while NEFT processes in batches.

- Transaction Limit: RTGS is for upper-value transactions with a higher minimum limit, NEFT has no minimum limit but is slow and steady.

RTGS vs. IMPS

- Availability: While IMPS is available 24 HRS, RTGS is usually available during bank hours.

- Transaction size: IMPS for small transactions while RTGS for big ones.

Conclusion:

RTGS money transfer is a healthy, efficient system for high-value transfers that require instant settlement. Real-time processing, high security, and ease of big transactions make this an important tool in today’s banking. Understanding the benefits, limits, and charges of the system will help people and businesses alike to make informed decisions on using RTGS for their financial needs.

FAQs

How does the Payment under RTGS Work?

RTGS payments are the processing of high-value transactions individually or in real-time through an RTGS system. They find major applications for transactions that require immediate settlement due to their large amount and urgent type.

What is Fast NEFT or RTGS?

Fast NEFT and RTGS are both electronic payment systems. NEFT settles transactions in batches, which are then dispensed on an hourly basis, while RTGS clears those transactions that are to be immediately processed.

What could be the limit for RTGS Transfer?

The minimum amount to be transferred through RTGS is usually high and any central bank decides upon it. For example, in India, it is INR 2 lakhs, with no upper limit for transfer.

Know about: SWIFT Payment, SWIFT Alternatives, ACH Transfer, Overseas Payment

Do follow us on Facebook and LinkedIn, to stay connected with us