In the realm of finance, Neobank, also referred to as a Challenger bank and Digital-only bank, is a buzzword commonly associated with digital banking.

However, neobanks are more than just digital banks; they are a bandwagon to change how global financial transactions are affordable, mobile, prompt, and free from the inexplicable fees that traditional banking incurred.

Thanks to neobanks, the banking sector is no longer a space occupied solely by traditional banks.

Usually, when one explains the concept of banking, it is riddled with notions of tediously visiting physical banks, filling out long sheets of paperwork, queuing up in slow-moving lines, dealing with red tape, and wasting valuable time.

Also, do not forget the lunch breaks of the bank employees and the seemingly eternal wait times for even a simple transaction. Forget about the global payments even local payments seemed a lot of hassle and a chore.

However, with the advent of digital technology and the intertwining of technology with all the banking processes and the internet, all the evident problems of traditional banking were solved by neobanking services, hence transforming the financial landscape.

Also, the 2008 financial crisis and the COVID pandemic further consolidated the concept of the need for digital banks, and exposed how vulnerable conventional banking practices are in the modern era, and the use-case of purely digital banking even during a period of emergency was demonstrated, respectively.

Furthermore, the need for stricter regulations, and monitoring transactions was also evident to protect the financial systems from contingent vulnerabilities like the 2008 financial crisis, which could only be achieved if the transaction were driven digitally.

Additionally, before the 2008 financial crisis, companies like Simple (founded in 2009) in the United States and Fidor Bank also founded in 2009 in Germany have become pioneers in the neobanking revolution.

But it was easier said than done. The legacy systems used by conventional banks and the complex, poorly designed banking networks all seemed impossible to cope with the needs of the 21st century.

Banking is no longer just about physical branches, lots of paperwork, and complicated processes.

Now, we have banks without locations, quick online transactions, borderless accounts, easy global investments through apps, secure blockchain technology, and no hidden fees as the new standard.

this blog will help you discern how neobanks are not just equal but a better banking solution for you, and how this groundbreaking idea changes how we perceive banking.

Read about: Best Neobank for Business Transactions in 2025.

What are Neobanks?

Though you must have gotten a gist of what neobanks are, let us delve deeper into how they function and add to what you might have already known.

Neobanks are fintech companies that have no physical location, operate 100% digitally, and provide banking services akin to software-as-a-service via mobile apps and websites.

Our fast-paced lives now do not have time for a visit to a physical branch, and since we are adept with technology, neobanks should be the best option forward.

Furthermore, their offerings revolve around the simplification of the banking experience and the realization of all banking needs in a digital form.

Challenger Banks; A synonymous phrase is apt as they have acted as a financial industry disruptor and challenged century-old banking practices with comparatively cheaper, faster turnaround time (TAT), convenience with the digital applications, and the usage of neobanks has skyrocketed.

For instance, Chime a neobank from the United States has 22 Million Customers solely in the United States, and Wise a global neobank has 16 million users from its report of 2023.

A Global Outlook on Neobanks

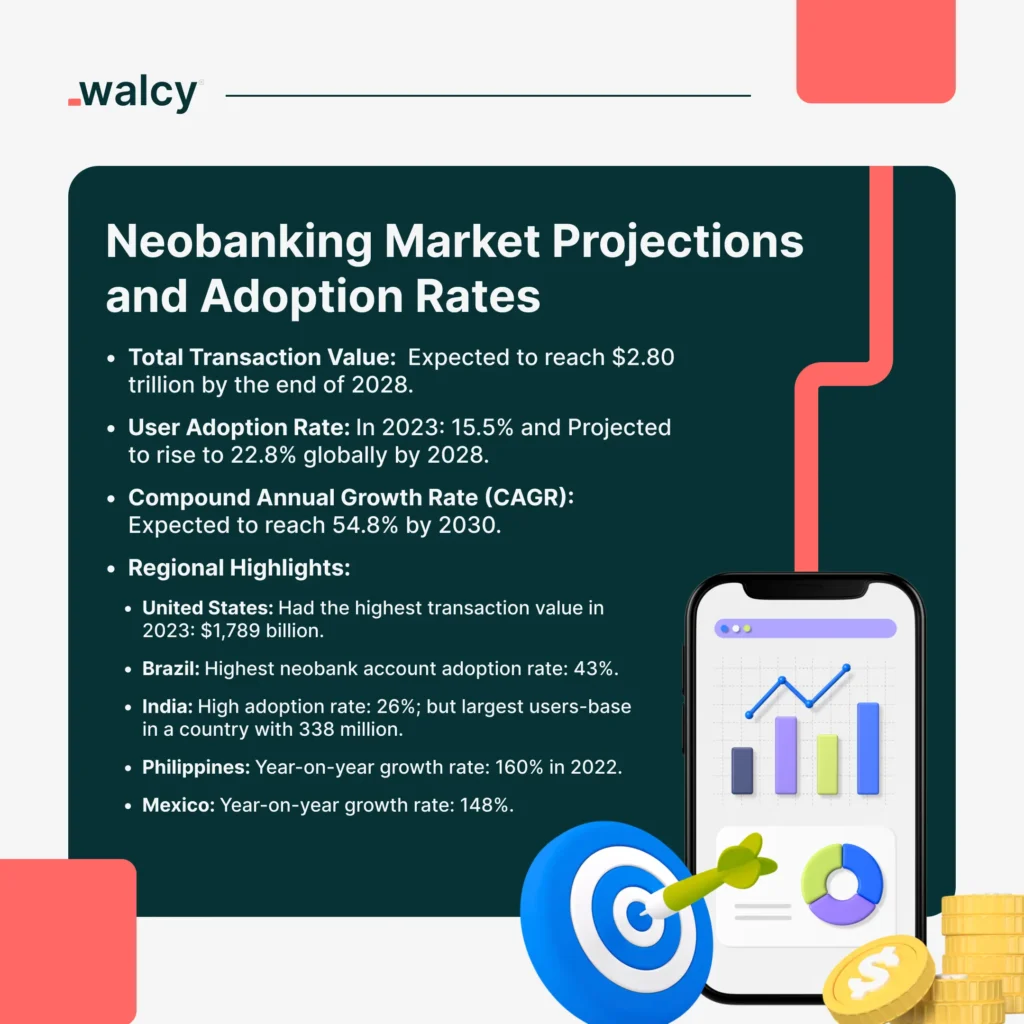

Statista 2024 report heralds that the total transaction value of neobanking might reach $2.80 trillion by the end of 2028. The report forecasted a user adoption rate of 15.5% in 2023, which is expected to rise to 22.8% over the next five years, globally.

Statista 2024 report heralds that the total transaction value of neobanking might reach $2.80 trillion by the end of 2028. The report forecasted a user adoption rate of 15.5% in 2023, which is expected to rise to 22.8% over the next five years, globally.

As per the research done by the Grand View, the Compound Annual Growth Rate (CAGR) of the global neobanking market is expected to reach 54.8% by 2030.

The highest value of transactions as per the country that occurred was in the United States which was approximately 1,789 Billion dollars as of 2023.

Brazil and India have the highest neobank account adoption rates of approximately 43% and 26%, respectively.

However, the number of users in India is the highest given the 1.3 Billion population, further, the 2014 demonetisation further fuelled the need for a digital banking solution in India which contributed to a massive increment in adoption rate.

Also, in the case of Brazil, Covid fueled the need for neobanks in Brazil and Brazil pushed the idea of digitalisation of its economy, and the growth rate of Brazilians with neobanks accounts surged significantly.

Furthermore, the neobanks are performing strongly in emerging markets as the year-on-year growth rate of the Philippines is around 160% in 2022, and 148% in Mexico, which portrays global adoption of the concept of neobanking.

To sum up, the neobanking sector is booming globally, with transaction values expected to hit a whopping $2.80 trillion by 2028. User adoption rates are climbing, projected to reach 22.8% by then.

Brazil and India lead in adoption, driven by factors like COVID-19 digitalization, and demonetisation. Emerging markets like the Philippines and Mexico are also embracing neobanking, showing robust growth rates.

Neobank’s Business Model and How it Differs From Conventional Banking

Neo-banks partner with traditional banks or obtain their banking licence to create bank accounts and facilitate transactions, which depends upon the regulatory requirement set in the country or region the company is based.

The key technology they use is cloud technology coupled with APIs (Application Programming Interfaces) to enable systemic communication with users’ devices and financial processing systems.

The models differ as per the target market, the revenue streams, and the cost structure, which are as follows:

B2C (Business-to-consumer):

Usually neobanks in this category, facilitate retail banking services, and they target individuals rather than businesses.

They facilitate the creation of savings accounts, current accounts, debit cards, credit cards, instant loans, micro-investments, insurance, buy-now-pay-later(BNPL) services, and many more.

Their revenue model is primarily based on commissioning models such as transaction fees, onboarding fees, subscriptions, and interests on loans. For example, Wise, N26, and Revolut are based on this model.

B2B (Business-to-Business):

Neobanks in this category offer financial requirements as per the needs of corporates, such as corporate business accounts, international payment solutions, invoicing and billing solutions, lending, recurring payments, and payroll management.

They provide a consolidated reporting dashboard to monitor and have an overview of their financial metrics. The revenue generation is via fees, subscriptions, flat payouts, account maintenance, and FX fees.

Read about: Ultimate Guide To B2B International Payments In 2025.

Banking-as-a-service (BaaS):

This form of banking model primarily provides a platform and infrastructure for fintech companies, allows non-financial companies to embed finance in their offerings, aggregates several financial services from multiple fintech companies, and sometimes enables traditional to become a digital bank.

BaaS platforms facilitate APIs and services that allow creators to build banking applications without having to develop core banking functionalities by themselves, this enables non-financial companies to realise banking functionalities in various systems.

This enhances the entire value chain from provider, aggregator, distributor, and experience.

In the case of a fintech in the stage of provider, BaaS streamlines operations by offering a complete backend infrastructure with the ability to request APIs and compliance resolutions, enabling them to focus on innovation rather than tedious maintenance banking back-end services.

Other part of the BaaS value chain are the aggregators allowing the aggregation of multiple financial services using APIs.

An aggregated list of APIs from multiple providers allows them to offer comprehensive financial solutions to their customers, which they can combine to innovate.

Finally, BaaS transforms the user experience by providing the development of innovative financial products and services that are secure, scalable, and compliant with the regulatory body.

Read about: Top 8 Fintech Trends of 2024 & 2025

Challenges for Neobanks

Regulation is one of the hurdles for the neobanks since neobanking services can be provided by non-financial companies, the regulatory guidelines are not clear or are non-existent which hinders the growth of neobanks in certain markets in the world.

Trusting and creating assurance amongst new adopters is a real challenge, since physical branches are non-existence, people generally feel that their money is not secured.

It is also prone to cyber-attacks and distributed denial of service attacks might render the neobank useless creating further scepticism.

Neobanks must focus deeply on providing top-notch customer services, and fuel customer loyalty through impeccable services.

Market Saturation and Differentiation are another difficulty. With the expansion of neobanks, the market is becoming increasingly saturated.

Standing out in the competition requires unique value propositions, innovative features, strong marketing and sales efforts, and personalized experiences to attract and retain customers.

Achieving positive cash flow and induced profitability in the extremely competitive and cost-intensive banking sector is a pertinent challenge for neobanks, particularly in the early stages of growth.

Balancing customer acquisition costs, operating expenses, and revenue generation is crucial for the long-term sustainability of a neobank.

Conclusion

In essence, neobanks have revolutionised banking by offering digital-only services, challenging traditional practices with speed, convenience, and transparency.

Their main modus operandi is to leverage technology to simplify transactions, transcending borders and eliminating hidden fees.

Further, despite reliance on conventional banks for regulatory compliance, neobanks thrive, with a projected transaction value of $2.80 trillion by 2028.

Finally, the challenges include regulatory ambiguity, building trust, market saturation, differentiation, and achieving profitability.

Sources

- Ron Shevlin, “Is Chime, The Largest Digital Bank, Ready To Go Public,” Forbes, March 24, 2024, https://www.forbes.com/sites/ronshevlin/2024/03/24/is-chime-ready-for-an-ipo-it-has-more-primary-customers-than-chase/?sh=56c559925d38.

- Statista, “Neobanking,” https://www.statista.com/outlook/dmo/fintech/neobanking/united-states.

- Grand View Research, “Neobanking Market Size, Share & Trends Analysis Report By Account Type (Business, Savings), By Application (Enterprises, Personal), By Region (Asia Pacific, Europe), And Segment Forecasts, 2023 – 2030,” https://www.grandviewresearch.com/industry-analysis/neobanking-market.

- Tamas Kadar, “Which Countries Exhibit the Greatest Neobank Adoption per Capita?” SEON, https://seon.io/resources/neobanking-index/.

Please refer to the Terms, Privacy Policy and product availability applicable to your region, or visit the Walcy Pte. Ltd. website for the most current details about service availability, markups, payout costs, and related fees.

We do not make any express or implied representations, warranties, or guarantees regarding the accuracy, completeness, or timeliness of the content in this document.

This blog serves as general information and does not constitute legal, tax, or other professional advice from Walcy Pte. Ltd. It should not be relied upon as a substitute for consulting a financial advisor.

Going through this blog is recommended if you are considering opening a foreign currency account.

Additionally, know the benefits of global accounts here.

Do follow us on Facebook and LinkedIn, to stay connected with us.

By – Dr. Adhikari B | CEO/Co-Founder Walcy